Australia – ANZ Job Advertisements

Contents

Today, at GMT 12:30 a.m., Australia and New Zealand Banking Group (ANZ) released its monthly Job Advertisement figure, which measures the changes in the number of advertised jobs in key Australian cities through the major daily newspapers and web portals.

Since job advertisements usually lead to hiring employees, binary options traders consider this data from ANZ to be a leading indicator of the employment trend in the country. The ANZ Job Advertisement figure usually has greater impact on the Australian Dollar when it is released before the Australian government’s official employment data.

Last month, the ANZ Job Advertisement figure had a growth of 0.3%, and this month it grew by 1 percentage point, and the actual figure indicated a 1.3% growth in the number of job advertisements.

New Zealand – Official Cash Rate

On Wednesday, at GMT 8:00 p.m., the Reserve Bank of New Zealand will release the Official Cash Rate, which is the interest rate that banks in New Zealand use to lend funds held at the central bank.

Binary options traders consider the official cash rate to be the most important factor of the valuation of the New Zealand Dollar against other currencies. In fact, most of the other fundamental indicators are considered just to predict future interest rate.

Last month, the RBNZ left the official cash rate at 2.75% and the forecast for this month is currently set at a slightly lower rate of 2.50%.

Trade Recommendation for the AUDNZD

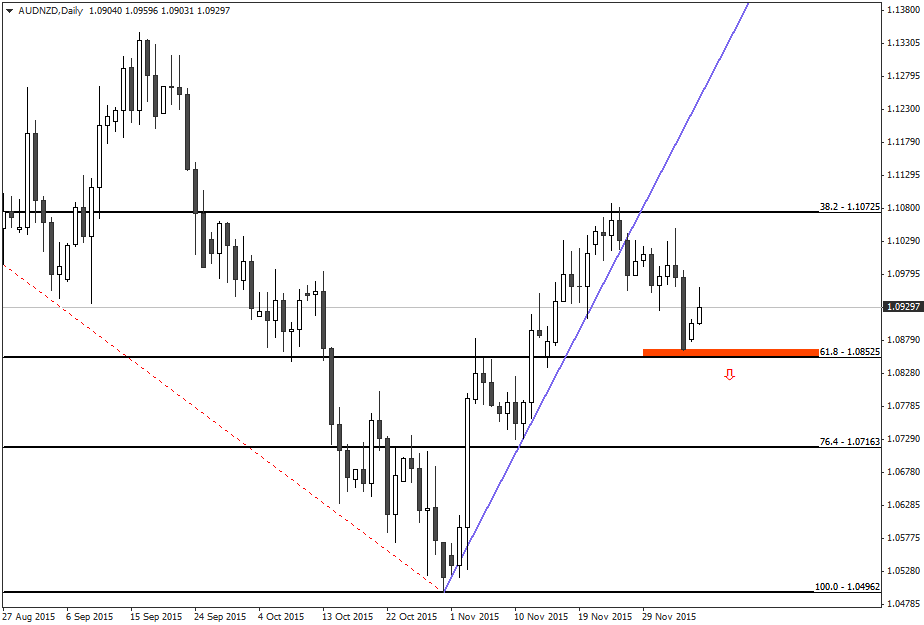

Since July 2015, the AUDNZD has remained in a long-term downtrend. However, at the end of October, the AUD/NZD started a bullish retracement move and the price climbed up to the 38.2% Fibonacci retracement level.

But, on November 26, the AUD/NZD price broke below the uptrend line formed by the retracement move and resumed the downtrend.

Last week, the downward move accelerated and the AUD/NZD price reached near the 61.8% Fibonacci level. However, the week ended with a large bearish inside bar. Currently, the AUD/NZD price is trading within the inside bar formed on last Friday.

Under the circumstances, it is recommended that traders consider placing a PUT order for the AUD/NZD with their binary options brokers once the price penetrates and closes below the support around the 61.8% Fibonacci retracement level, which is at 1.0852.

Recommended Broker: IQ Option

IQ Option is one of the most trusted and popular binary options platform nowadays for traders. Check out our IQ Option review.

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $1,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 92%*

Tagged with: AUD/NZD • Trade of the Week