New Zealand – Trade Balance

Contents

Yesterday, at GMT 9:45 p.m., the Statistics New Zealand released the national trade balance figure, which measures the difference of the value between net import and net export of the country during the previous month.

Since the export of a country is directly correlated to the demand for its currency, a positive trade balance figure indicates that foreigners had to buy more local (NZD) currency in exchange of their domestic currency. Hence, economists and binary options investors consider the trade balance to be an important indicator of the health of the New Zealand’s economy.

Last month, the trade balance figure of New Zealand came out at -$1079 million, and this month the forecast was set a much better figure, at -$822 million. However, the actual trade balance figure came out much worse than what the market was expecting, at -$1222 million.

Canada – Raw Materials Price Index

Later in the week, on Thursday, at GMT 12:30 p.m., the Statistics Canada will release the month-over-month Raw Materials Price Index (RMPI), which measures the changes in the price of raw materials bought by manufacturers in the country over the past month.

Binary options traders consider the RMPI to be an important leading indicator of consumer inflation in Canada, because if manufacturers pay more to buy raw materials, then ultimately the retail customers end up paying for the higher cost of production.

Over the past several months, the Canadian RMPI has been gradually increasing. But, in September, it fell by 6.6%, after falling by 5.9% in August. If the current trend continues, it would add additional bearishness to the Canadian Dollar.

Trade Recommendation for the NZD/CAD

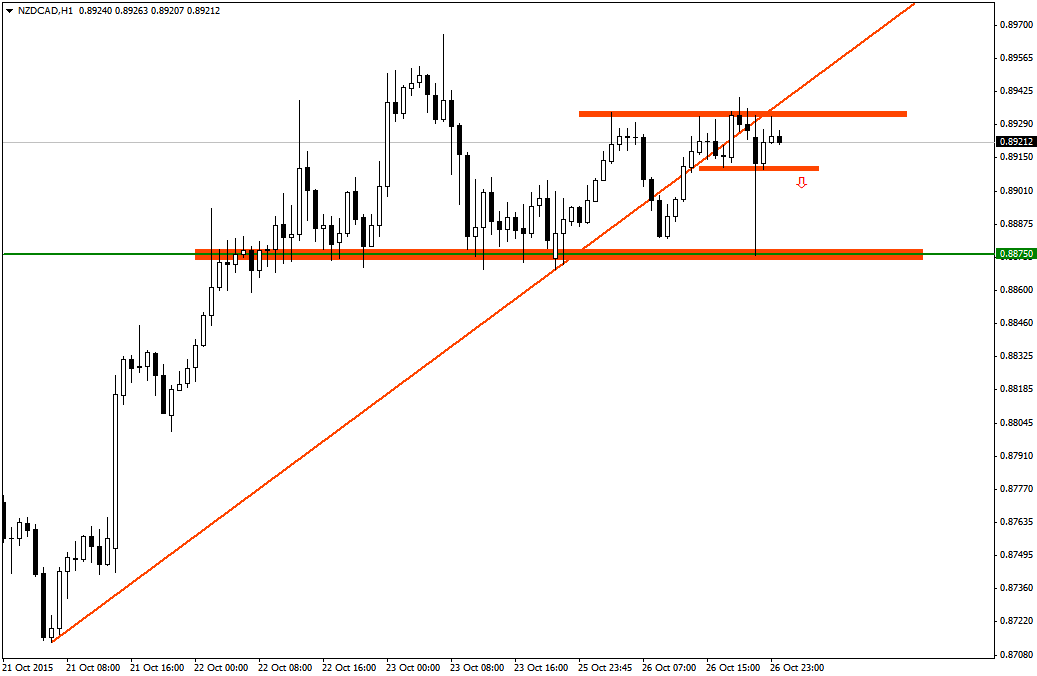

At the end of the last week, the NZD/CAD has been trending up. After the market opened on Monday, it found support around the 0.8875 level several times and the remained above this level.

As the New Zealand’s trade balance figure has declined to historical levels, the fundamental outlook for the NZD/CAD would likely remain bearish for next 48-hour period. Hence, there is a good chance that the NZD/CAD price will once again try to penetrate below the 0.8875 level. This would offer binary options traders with an opportunity to place a PUT order.

Under the circumstances, it is recommended that traders consider placing a PUT order for the NZD/CAD with their binary options brokers once the price closes below the intermediate support level around 0.8910 on the 60-minute timeframe (H1).

Recommended Broker: GOptions

GOptions is one of the oldest and most trusted binary options platform nowadays for traders

- $200 Minimum Deposit

- Up to 100% Deposit Bonus

- Up to 90% Payout

- Excellent Customer Service

- Fast withdrawals

Tagged with: NZD/CAD • Trade of the Week