Fibonacci is one of the favorite tools of Forex traders. Although there are some natural world examples of Fibonacci ratios, do not get confused that there is some hidden pattern in the Forex market based on these ratios.

The Reason Fibonacci Confluence Zones Works

Contents

As far as the academic research is concerned, prices in the financial markets move randomly. That includes the global foreign exchange market. Now, the reason Fibonacci and any other pattern works is because enough people “think” these patterns work. Meaning, Fibonacci ratios work as a self-full feeling prophecy.

Think like this, if all the market participants believe that at the 61.8% retracement level, the price of EUR/USD will find resistance, regardless of the underlying market fundamentals, if there are enough sell orders at this level, the price will find resistance there. Simple.

Hence, using multiple Fibonacci ratios that meet near a pivot zone can provide binary options traders some good opportunities to trade. Because around these confluence zone, the chances of having a large quantity of pending buy or sell orders are high. Hence, when the price moves above or below these confluence zones, the momentum is often high, which pushes the price in any direction at a fast pace.

How to Trade Binary Options Using Fibonacci Confluence Zones?

Trading binary options with Fibonacci confluence zones are very easy, but it takes long-term dedication and practice to master the art of finding these confluence zones.

The idea is to draw a bunch of Fibonacci retracement levels and try to find a price level where multiple Fibonacci levels of different price swings meet.

Example of Trading Binary Options with Fibonacci Confluence Zones

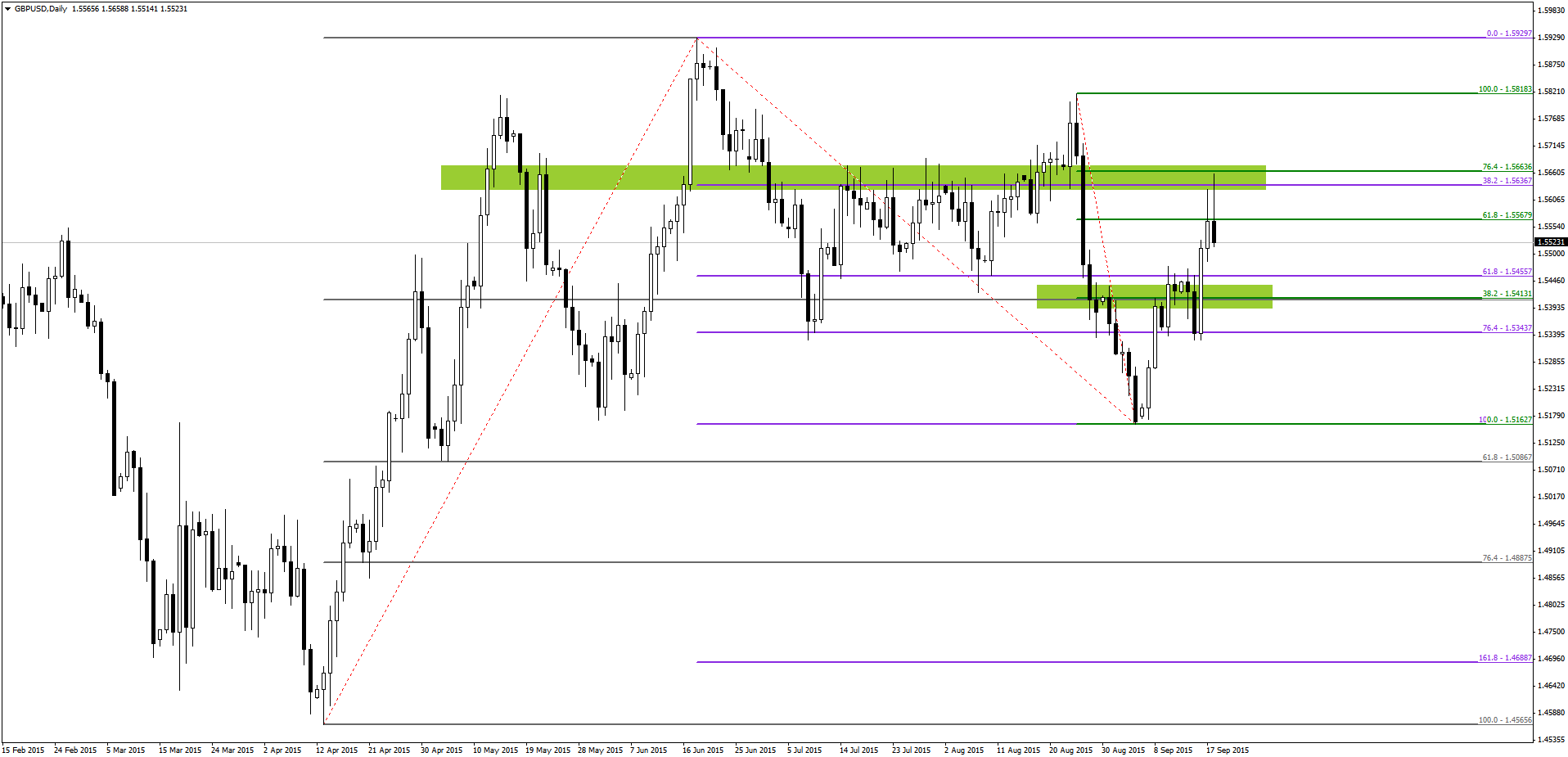

This this example chart of daily GBP/USD chart, we have applied the built in Fibonacci retracement tool three times on three different price swings. Each price swing is colored differently so that you can easily find out the high and lows of these swings.

You can apply and draw Fibonacci retracement levels as many times on a given chart and that’s not an issue.

The key is to find a zone where multiple Fibonacci levels from different price swings have consolidated and created a pivot zone, where price consistently found either support or resistance.

We have identified a major Fibonacci confluence zone and a minor one in the chart above.

Once you have identified a Fibonacci confluence zone, draw the high and low of the zone.

When price closes above the high of the confluence zone, place a CALL order. Similarly, when the price closes below the low of the confluence zone, place a PUT order.

Conclusion

You can also combine any other system with Fibonacci confluence zones in order to improve your odds of winning as a binary options investor. For example, combining price action entry method or your favorite indicator that provides entry signals can improve your success rate.

Tagged with: binary options • Fibonacci • Strategy