Japan – Retail Sales

Contents

Yesterday, at GMT 11:50 p.m., the Japanese Ministry of Economy, Trade and Industry (METI) released the year-over-year retail sales data, which measures the changes in the total value of sales made by the retailers in Japan over the past month. This data is published in an annualized format.

Since the retail sales data acts as the main gauge of consumer spending in Japan and consumer spending accounts for a large portion of overall economic activity in the country, binary options traders consider this to be one of the most important fundamental indicators of the Japanese economy.

In October, the Japanese retail sales figure decreased by 0.1% and the forecast for this month was set at an increase of 0.9%. However, the actual figure came out much better than expected, at 1.8%.

Eurozone – German Retail Sales

Today, at GMT 2:00 a.m., the Destatis released the month over month German retail sales data, which measures the changes in the total value of sales at the retail level in the country.

Since the German economy makes up a large portion of the overall Eurozone economy, and the retail sales acts as a primary measurement of consumer spending and consumer confidence, binary options investors consider it to be an important fundamental indicator.

In October, the German retail sales figure remained unchanged and the forecast for October was set at a modest growth of only 0.3%. However, the actual figure came out much worse than what the market was expecting, at -0.4%.

Trade Recommendation for the EUR/JPY

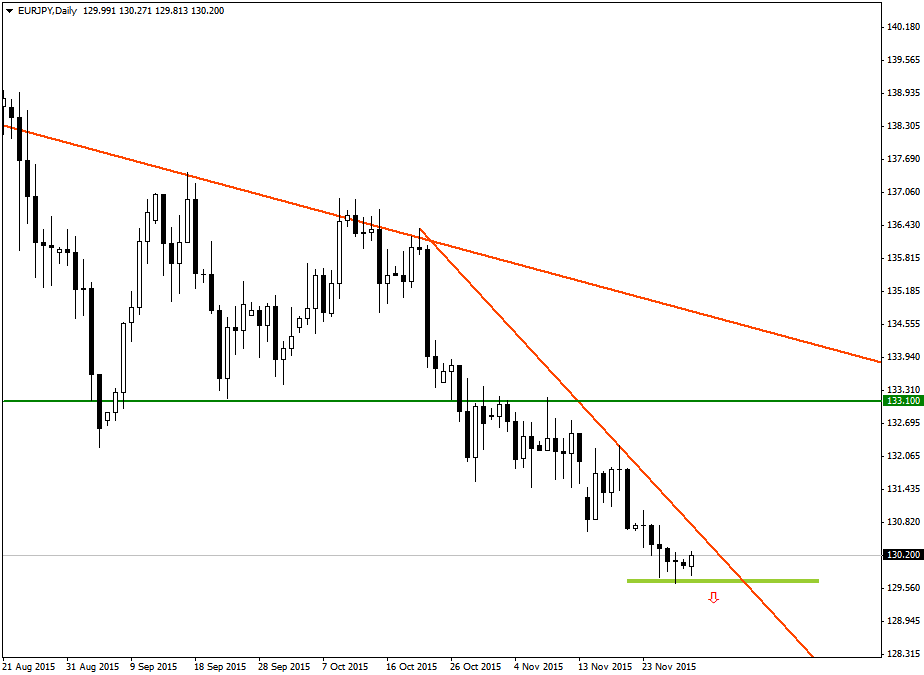

Since the second week of October, the EUR/JPY has remained in a strong downturn and formed a downtrend line in the process.

As the Japanese retail sales figure came out much better than expected and the German retail sales came out worse than expected, the fundamental outlook for the EUR/JPY would remain bearish for the week.

Although the EUR/JPY price has been going up since the market opened this week, the probability of additional bearishness remains high.

Under the circumstances, it would be recommended that traders consider placing a PUT order for the EUR/JPY with their binary options brokers once the price penetrates and closes below last week’s low, which is at 129.65.

Recommended Broker: IQ Option

IQ Option is one of the most trusted and popular binary options platform nowadays for traders. Check out our IQ Option review.

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $1,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 92%*

Tagged with: AUD/JPY • Trade of the Week