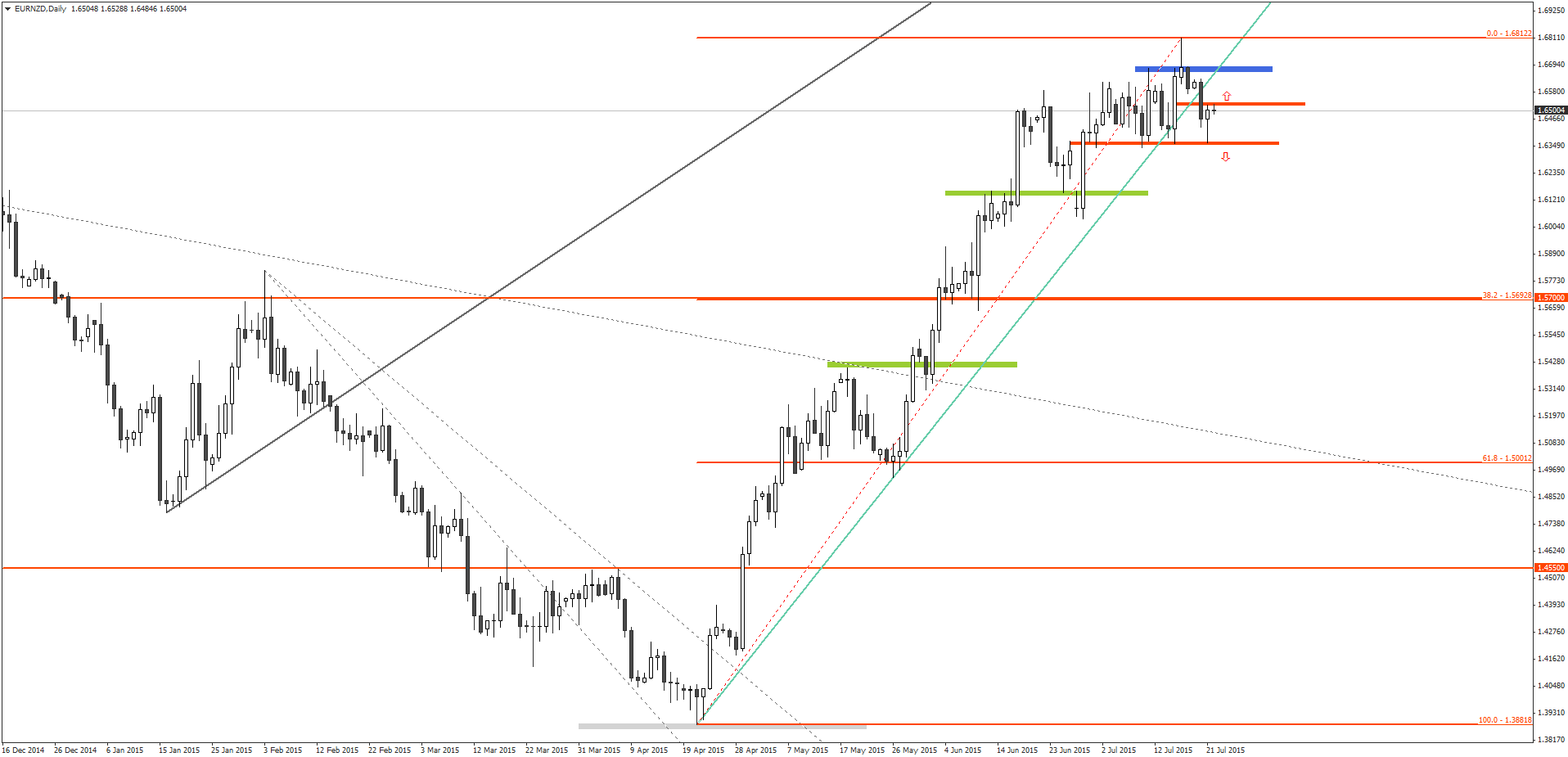

The EURNZD has remained in a strong uptrend since forming a bullish pin bar on April 21, and formed a distinct uptrend line over the past few months.

However, last week on July 16, the EURNZD price was rejected around the 1.6800 level, after reaching as high as 1.6812. The bearish pressure pushed the price towards the high from July 10, which is around 1.6690. As the daily closing price was lower than 1.6690, the pair effectively formed a bearish pin bar at the top of the uptrend.

Subsequent bearish momentum broke below the low of the pin bar on July 17, and the sellers pushed the EUR/NZD price towards the support level around 1.6350 this week. This bearish move in the last few days also penetrated the uptrend line. Hence, from a technical point of view, the EUR/NZD uptrend may be coming to an end.

However, the Reserve Bank of New Zealand is expected to cut the key overnight rate to 3.0% from 3.25% this week and the trade balance is expected to come down to 100 million compared to 350 million from the previous month.

In addition, the EUR/NZD formed a bullish pin bar yesterday, which is signaling additional bullish move despite the price penetration below the uptrend line. The binary options market is largely driven by economic fundamentals and we always recommend traders to follow the fundamental direction of the market.

Hence, it is recommended that traders consider placing a CALL order with their top binary options brokers once the EUR/NZD price closes above yesterday’s high, at 1.6524.

Recommended Binary Options Brokers

[bonustable_fixed site1=’8′ site2=’333′ site3=’120′ site4=’189′ ]Tagged with: Free Signal