Eurozone – Unemployment Rate

Contents

Today, at GMT 9:00 a.m., the Eurostat released the unemployment rate of the Eurozone. This unemployment rate measures the percentage of the total work force who were actively seeking employment opportunity during the previous quarter.

The unemployment rate is usually considered as a lagging economic indicator. However, it indicates the future consumer spending in the economy as people with jobs and steady paychecks tend to spend more. Hence, binary options traders consider this to be an important indicator of the overall economy.

During the last quarter, Eurozone unemployment rate came out at 11.1% and the forecast for this quarter was set at 11.1% as well. However, the actual figure came out much better than what the market was expecting, at 10.9%.

United States – Institute for Supply Management (ISM) Manufacturing PMI

Today, at GMT 2:00 p.m., the Institute for Supply Management released its manufacturing PMI figure for the United States, which measures the level of a diffusion index by surveying 400 purchasing managers in the country.

Purchasing managers in the United States are involved in the supply side of the economy. As most companies reduce their expenses and production based on their sales forecast, the survey of purchasing managers reveals the overall optimism of various companies in the country. Hence, binary options investors can easily figure out the market sentiment regarding the economic condition in the country from the ISM manufacturing PMI readings.

In August, the ISM manufacturing PMI for the United States came out at 52.7 and the forecast for September was set at 52.6. However, the actual reading came out much lower than expected, at 51.1.

Trade Recommendation for the EUR/USD

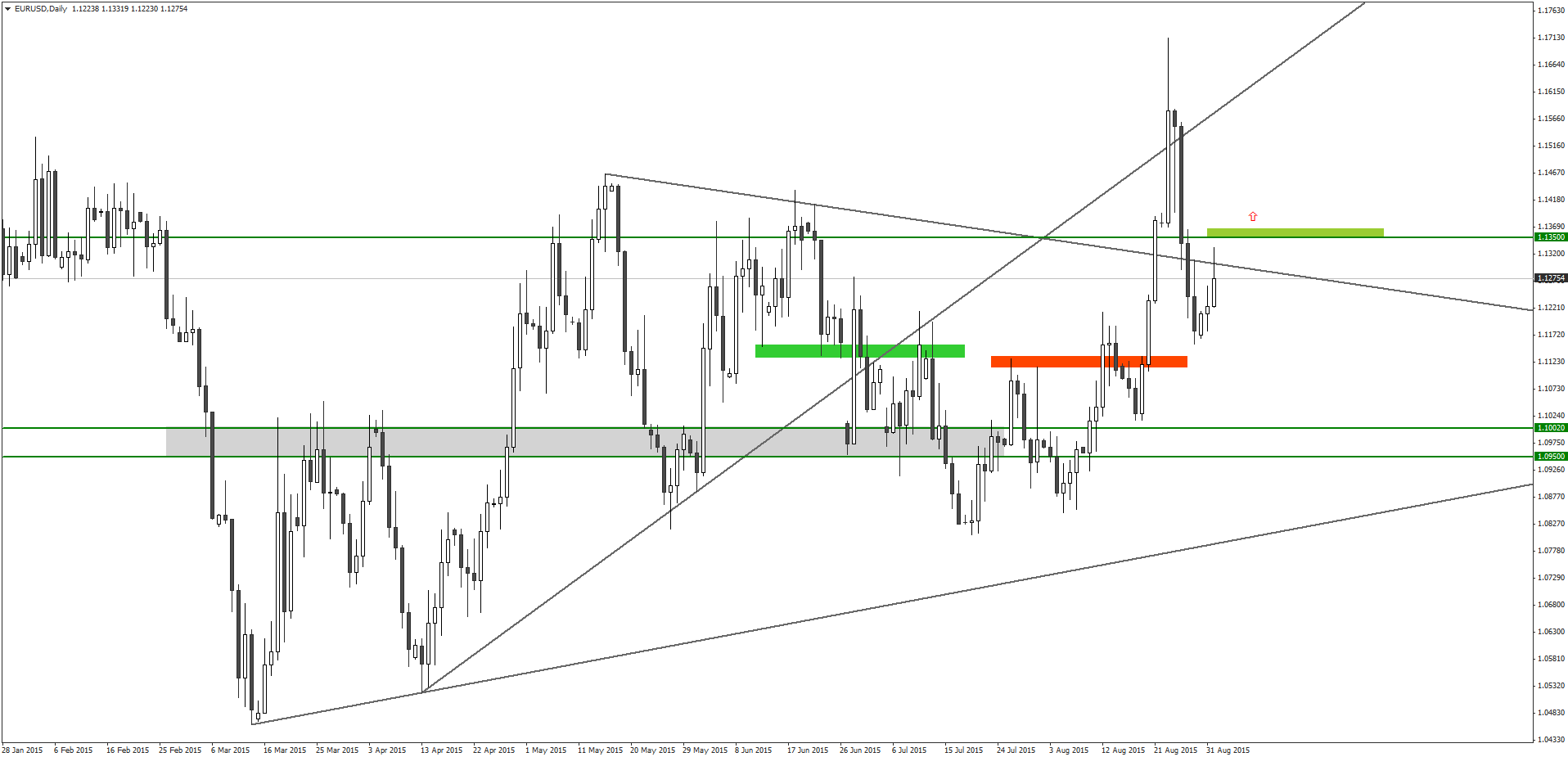

Over the last week, the EUR/USD price has become extremely volatile as the pair has gone up 700 pips since August 20, but also fell around 550 pips in the last few days.

After the EUR/USD price closed below the downtrend line on August 27, it tested the resistance around the trend line on August 28, but failed to penetrate above this level.

Today, the EUR/USD price once again tested this downtrend line, but after penetrating it, the bearish pressure pushed the price below this level.

As the Eurozone unemployment rate has fallen to 10.9%, the fundamental outlook for the EUR/USD would remain bullish this week. If today’s daily bar closes above the downtrend line and the psychological level around 1.1350, it would certainly attract additional bullish momentum in the market.

Under the circumstances, it is recommended that traders consider placing a CALL order for the EUR/USD with their binary options brokers, once the price penetrates and closes above the resistance level around 1.1350.

Recommended Broker: IQ Option

IQ Option is one of the most trusted and popular binary options platform nowaday for traders.

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $1,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 92%*

Tagged with: EUR/USD • Trade of the Week