USDSGD Outlook and Technical Analysis for Singapore Brokers

Contents

Introduction

The Singapore dollar shows strength against the USD on all Singapore broker terminals following an increase in demand after last week’s bearish closing price of the USDSGD.

Read on as we expose crucial technical and fundamental drivers of the USD vs. Singapore dollar.

Singapore Gross Domestic Product (GDP)

The GDP of Singapore is a measure of the annual variation in the inflation-adjusted valuation of all goods and services produced within the country. GDP, which is the primary indicator of the robustness of the economy, is also the broadest measure of economic activity.

A reading that is higher than expected points to positive sentiment for the SGD while a lower than expected reading hints at a bearish trend for the SGD.

The latest data released on October 14th shows the previous reading to be -2.7%, while the Actual figure read 0.6%. It also showed the forecast figure to be 1.5%, pointing to positive sentiment for the Singapore Dollar.

Philadelphia (U.S.) Federal Manufacturing Index

The Philadelphia Fed Reserve Manufacturing Index uses data from a study of roughly 250 manufactures in the Philadelphia Federal Reserve district. It is an index that evaluates the relative level of general business conditions in Philadelphia.

A reading that is higher than expected points to positive sentiment for the USD while a lower than expected reading hints at a bearish trend for the currency.

The latest data released on September 19th show the previous reading to be 16.8, whereas the actual figure read 12.0. The data also showed the forecast figure to be 11.0, pointing to negative sentiment for the currency.

USDSGD Technical Analysis

USDSGD Long term Projection: Bullish

USDSGD: Monthly Chart

We start from the monthly time frame where the USD to SGD exchange rate close above the 50-period Moving Average in July. A hanging-man candlestick pattern formed after the close of September sends the price south below the October opening price.

The MA-50 appears to hold the price from crashing lower as the USDSGD trades above the 1.37147 Moving Average support.

USDSGD: Weekly Chart

Like the monthly time frame, the MA-50 from the above weekly chart holds the Singapore dollar from a further gain in strength. The current price decline may be confirmed as a mere correction of bullish rally from the earlier break of resistance on July 22.

If the current week closes bearish within the high/low range of October 07, we may look out for a break of the 1.37364 resistance by next week.

USDSGD Medium Term Projections: Bearish

USDSGD Daily Chart

Formation of regular bearish divergence patterns on August 16 and September 04, alongside a collapse of bullish support in the weekly time frame, set the current bearish tone of the USDSGD.

A collapse of inside-bar support on October 03 again switched the gear into a bearish decline forcing the pair to trade below the MA-50.

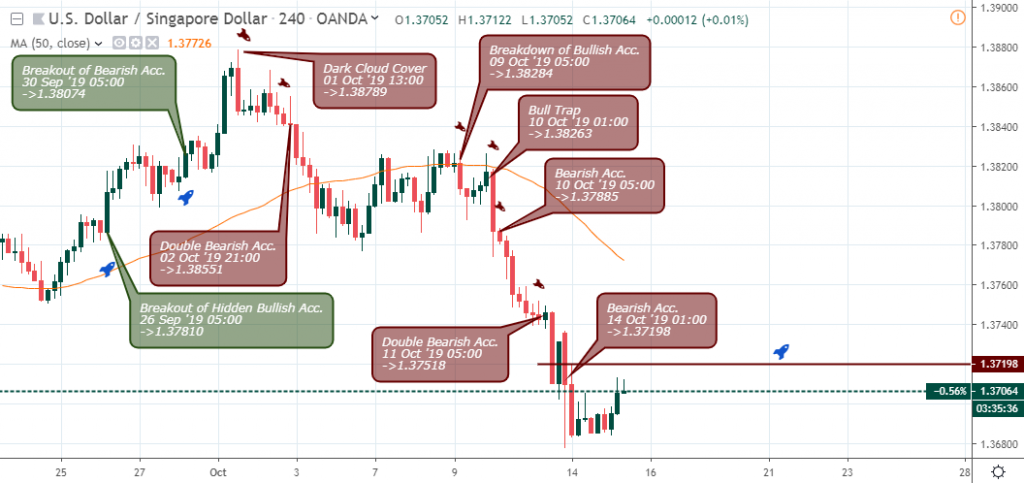

USDSGD H4 Chart: Bullish

Here on the 4hour time frame, we get a lower risk higher reward bearish entry setups with precession, starting from a failure of support and dark-cloud cover price pattern on October 01, followed by an increase in sell pressure on October 02.

As the bulls tried to make a recovery on October 08 at 17:00, the bears again showed strength and drove the price down by about 0.9% on October 09 and 10.

At publication time, the bulls breached the 1.37198 resistance on October 16, 01:00, hinting a likely upbeat campaign of the USDSGD on foreign exchange terminals.

Conclusion

Though the USDSGD trades below the weekly price open, the 50-period Moving Average is anticipated to hold the exchange rate from further decline. We’ll have to wait for a buildup of demand on the daily time frame as a signal to enter in the long direction — meanwhile, we lookout for opportunities to take profits from earlier sell positions.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021