United States – Existing Home Sales

Contents

Yesterday, at GMT 3:00 p.m., the US National Association of Realtors released the existing home sales number, which is the annualized number of residential buildings that were sold during the last month in the country. However, this figure excludes the number newly building constructions.

Since the sale of an existing home usually has a wide-spread positive ripple effect in the local economy, collectively this figure acts as an excellent leading indicator of the overall economic health of the country. Therefore, binary options traders consider the existing home sales number to be an important data as it tends to have a considerable market impact.

Last month, the US existing home sales figure came out at 5.47 million and the forecast for this month was set at 5.32 million. However, the actual figure came out well below the forecast at 5.08 million.

Japan – Tokyo Core CPI

On Thursday, at GMT 11:30 p.m., the Japanese Statistics Bureau will release the year over year Tokyo Core CPI figure, which measures the changes in the price of goods and services bought by consumers in Tokyo over the last month. However, this figure usually excludes the fresh produce as the volatility of fresh food price tends to distort the core numbers.

Since the consumer price makes up a large portion of the overall inflation in Japan and food prices have a major contribution to the CPI basket of goods, the food price of the capital Tokyo usually represents a great sample data for economists to predict the future inflation in the country. Hence, binary options brokers pay special attention to the Tokyo Core CPI data.

In February, the Tokyo Core CPI figure declined by 0.1% and the forecast for March is currently set at an additional (y/y) decline of 0.2%.

Trade Recommendation for the USD/JPY

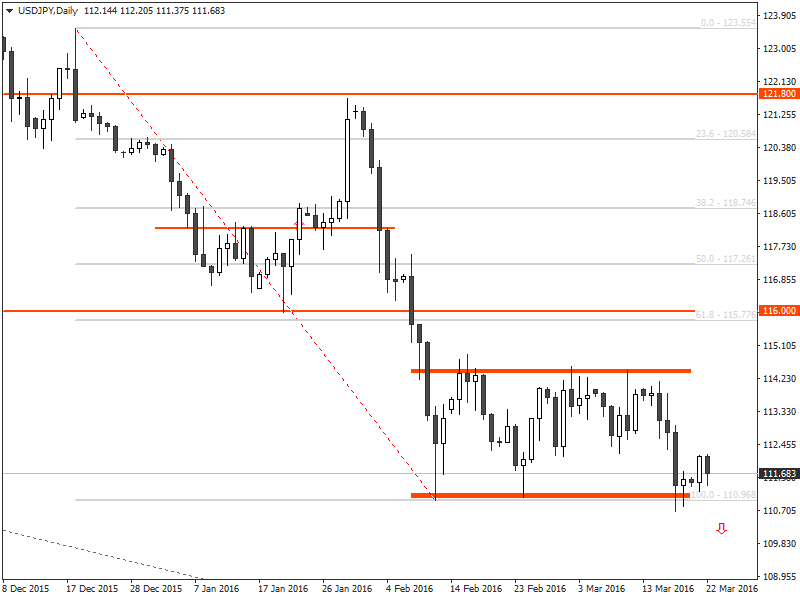

Although the USD/JPY has been on a downtrend for the last few months, after falling the price reached 110.96, on February 11, the pair mostly remained range bound between 110.96 and 114.40.

Last week, the USD/JPY price finally penetrated below the support level around the 114.40, but a lack of bearish momentum pushed the price quickly above the support, and it started a retracement move.

However, as the Existing Home Sales figure (y/y) in the United States grew at a much slower pace compared to last month, it would likely have a bearish fundamental impact on the USD/JPY outlook this week. Then, if the USD/JPY price closes below the 110.96, there is a good chance that it would attract additional bearish momentum in the market.

Under the circumstances, it would be recommended that binary options traders consider placing a PUT order for the AUD/JPY with their binary options brokers once the price closes below the 84.00 level.

Recommended Broker: BinaryBrokerZ

BinaryBrokerZ is one of the most popular binary options brokers. Check our our Binary BrokerZ review.

- Social Trading

- Up to 150% Deposit Bonus

- Up to 91% Payout

Tagged with: Trade of the Week • USD/JPY