USDSGD Technical Analysis for Singapore binary options

Contents

Introduction

The recent spikes of coronavirus infection in more states in the U.S. may create a ripple effect in the market over a resurgence in COVID-19 cases. Over 119,600 Americans have died from the virus to date as of the writing of this report.

The Island of Singapore has not enjoyed her exportation business in the last two months since the Covid-19 pandemic started, and the SGD is showing a loss of strength across Singapore brokers.

Singapore Fundamentals

Singapore’s non-oil domestic exports data showed a decline of 4.5% (May 2020), reversing from a 9.7% rise in April 2020. Among others, sales of non-electronics products plunged to -8.8% vs. 12.8% in April.

The labour market conditions changed because of the COVID-19 pandemic. However, during the March quarter, the number of employment fell by 25,600 as a significant fall in foreign employment affected the workforce and lockdown enforcement.

U.S. Fundamentals

The United States’ initial jobless claims data will be an essential factor for the Singapore broker and other investors because it measures the numbers of individuals who are filing in for unemployment for the first time in the past week. Some Analyst still believes that the economy still faces a long and challenging recovery from the COVID-19 recession.

If the data released is higher than the forecasted, it is a bearish action for the USD, while if it is lower than expected, it is a bullish ride for USD.

Forecasted data to be released is 1.320k, and the Previous was 1,508K.

USDSGD Technical Analysis

USDSGD Long-term Outlook: Bullish

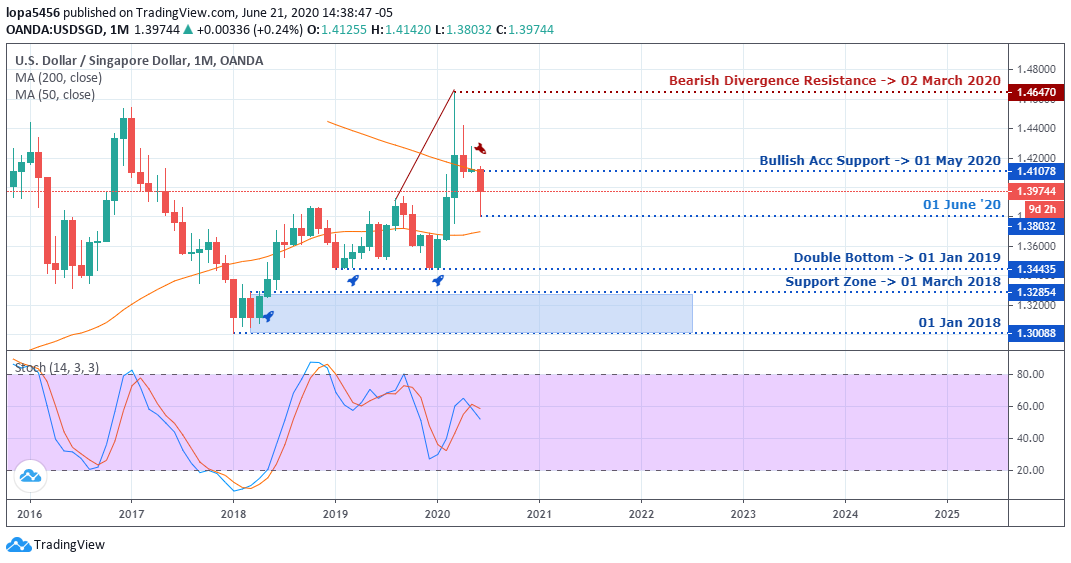

Monthly Chart

Monthly Resistance Levels: 1.46470

Monthly Support Levels: 1.30088, 11.32854, 1.34435, 1.38032, 1.41078

USDSGD price formed a double bottom chart pattern on 01 Jan 2019; the effect brought a bullish surged of the price up to the resistance level of 1.46470 before experiencing a correction.

The correction of USDSGD pushed the back price to the current zone of 01 Jun 2020, and it rejected USDSGD price at the support level of 1.38032.

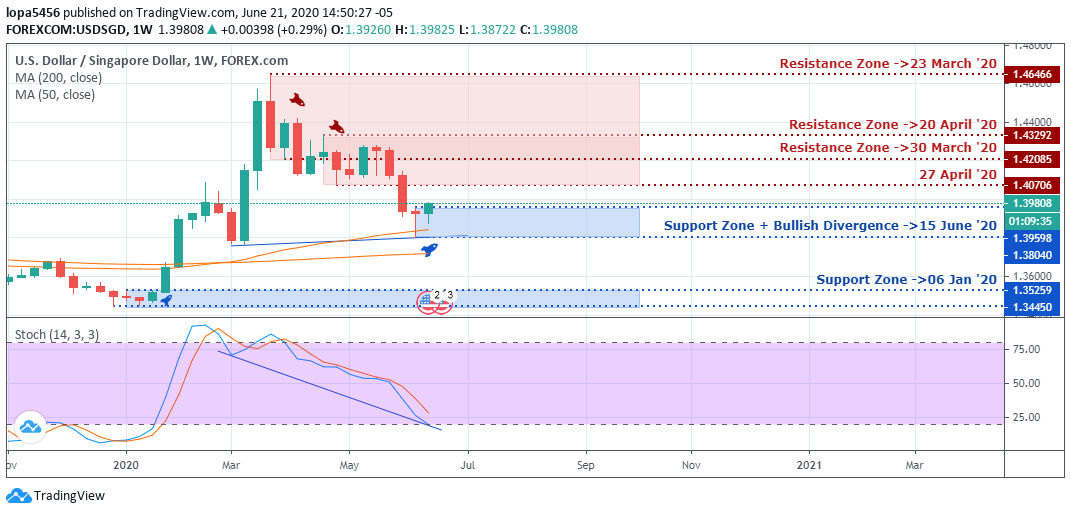

Weekly Chart

Weekly Resistance Levels: 1.46888, 1.43292, 1.42085, 1.40706

Weekly Support Levels: 1.34450, 1.35259, 1.39598

The USDSGD has been in a correction stage since the rejection of price around the 1.46888 resistance level. The bears have succeeded in pushing the price further down after breaking below the 30th March 2020 level.

The current week will be interesting for Singapore brokers because the close of the previous week shows us a sign of bullish divergence and firm support, which is likely taking the trend up.

USDSGD Medium-Term Outlook: Bullish

Daily Chart

Daily Resistance Levels: 1.46486, 1.44175, 1.43292

Daily Support Levels: 1.37598, 1.38040, 1.42387

After days of higher tops forming lower high and lower lows, we can see that the bears have dominated the trend for days from the 1.46486 resistance level.

After the bulls found firm support with a bullish engulfing at the 1.38040, we can see the bulls taking the price up to the 1.42387 resistance level.

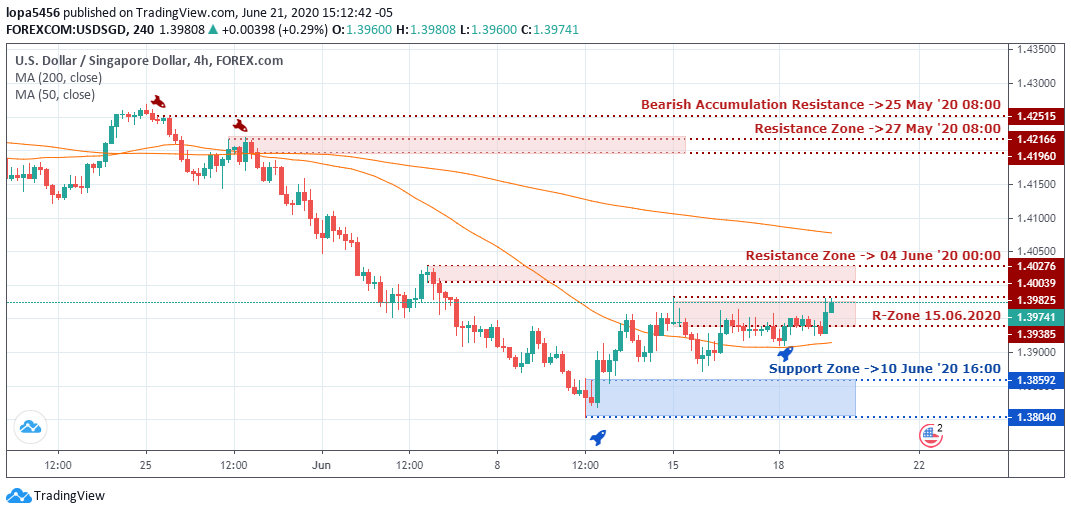

H4 Chart

4Hour Resistance Levels: 1.42515, 1.4186, 1.41980, 1.40276, 1.40039, 1.398255, 1.39385

4Hour Support Levels: 1.38040, 1.38592

On the 4 hours’ time frame, the bears were able to take control of the market from the resistance level of 1.42515 (25 May 2020) down to the support level of 1.38040.

The support zone is a substantial level because we can see how the USDSGD is trending up from the 1.38040 level as of the writing of this report. If the bulls’ strength is reliable, we may experience a breakout above the resistance zone of 04 Jun 2020 (1.40276).

Bullish Scenario:

A build-up to the continuation of the trend is seen in the 4 Hours -time frame.

The USDSGD is expected to resume an upward trend in a couple of weeks after the corrective stage of the market.

Bearish Scenario:

For some weeks and days, the bears have been in control of price. A failed attempt by the bulls may bring in a sharp sell from the resistance levels of 1.44175 on the daily time frame.

Conclusion

The Singapore broker will have a new week’s bias as events unfold in the coming days. Singapore foreign exchange has not been at its best since the COVID-19 crisis started; this brought a decline in exports among her trading partners.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021