Bitc0in Price Forecast

Contents

Introduction

The online brokers such as IQOption welcome the news from Bitfarms a bitcoin self-mining company that appointed Geoff Morphy as the Chief Operating Officer adding to his role as the president of the company. Could the consolidation and breakout of bitcoin by the end of the mini-bear cycle? Let us check out the charts for more information.

BTCUSD Technical Analysis

Monthly Chart Bullish

Monthly Resistance Levels: 69000.

Monthly Support Levels: 41000, 36800

The online brokers have seen the dominance of the Bears for the past two months. The shorting of BTCUSD pairs continues to favor the sellers as the momentum is still bearish on the monthly chart. The resistance zone has had more market participants selling off their positions to make profits from the holding of the crypto coins they have.

The market may continue to favor the Bears if they can push the price of the pair down to the 41000 level for a close below the zone. However, if they fail to close below the level the Bulls will fight back to recover from the loss it made to the sellers.

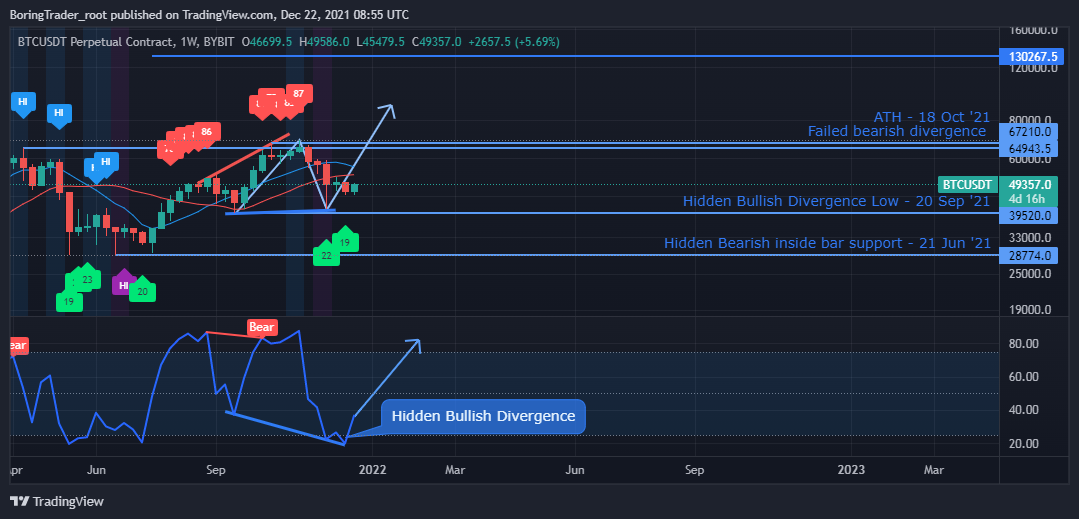

Weekly Chart

Weekly Resistance Levels: 59251, 69001

Weekly Support Levels: 41965, 45479

The BTCUSD pair had bears dominating the resistance zones of 69001 levels because the whales used the zones to take profit previously and they are using the zones again to sell off their positions to take profit. Online brokers have continued to believe in the crypto market because of its value and dominance in the cryptocurrency space.

The current support level of 41965 and 45479 on the weekly chart can be another great opportunity for the investors to buy bitcoin from the deep of the market as institutions like to take advantage of such opportunities.

Daily Chart

Daily Resistance 57650, 69000

Daily Support 41968, 45680.

Looking at the daily chart, the candlesticks have lost the bearish momentum they built from the high of 69000 some weeks ago. The BTCUSD pair will have to close lower than the support level of 41968 if the downtrend is to continue.

However, have the bearish run come to an end since the reaction of the market participants is showing a bullish buildup from the support zones of 41968 and 45680. If the momentum is sustained, crypto traders and retail traders will open long positions and a close above the 57650 level will take the price towards the ATH of the year.

H4 Chart

4 Hour Resistance 49350,

4Hour Support 45572, 45478

The BTCUSD pair have been battling at the support zone of 45572 and 45478 on the H4 time frame. A double bottom pattern is seen on the chart and it is building a Bullish momentum to take the price up. If the price of bitcoin can close above the support zone of 49350, the crypto market will attract more Bullish online brokers into the market.

The overall trend is bearish on the H4 chart, the trend will continue to go down when the price of the BTC/USD pair can close below the support zones price has consolidated.

Bullish Scenario:

On the H4 chart, we can see that the bullish momentum is building and if the buyers can take control of the zone the bullish scenario will come to play.

Bearish Scenario

However, the bearish scenario will continue the downward trend if the price of bitcoin can close below the support levels on the daily time frame.

Bitcoin BTC News Events

BITCOIN SPOT ETF ATTRACTING BILLIONS.

More investors are attracted to the bitcoin spot since it was kicked off in late October, a lot of cash has been invested into it. Report from Bloomberg market shows that the crypto wave swept across-the-board and financial institutions jumped on the bandwagons of cryptocurrency. Billions of investment were done under their management like Grayscale and Galaxy Digital among others.

A lot of attention has gone to the ProShares BTC Strategy ETF which was released towards the end of October because the US regulator SEC approved it as the first-ever Bitcoin ETF. The BITO has accumulated about $1 billion on the trading floor since the US institutions showed interest. Nothing further, the BITO tracks the future performance of Bitcoin and it is not a spot ETF.

The number of investment into crypto funds have doubled this year and analyst believes that the bitcoin spot ETF will attract more investors and demands the would be higher if a bitcoin spot exchange-traded fund is approved since it doesn’t bear roll costs relating to managing BTC contracts. Some analysis sees larger assets in the crypto space if there are more efficient structures.

Conclusion and Projection

Institutional interest rises as we can see that financial institutions are buying bitcoins like Grayscale who bought bitcoins worth millions. Investors are also investing in the bitcoin spot that the US SEC approved and it has seen so much fund invested into it since October that it approved.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd