Introduction

Contents

The battle line is drawn, the bulls and bears are at logger head bouncing the Bitcoin BTC price around like a ping pong as seen on all bitcoin broker sites such as OlympTrade, with the edge tilting a little more in favor of the bears.

Let’s move on to analyze the significant technical drivers as well as news event is the crypto space.

Bitcoin: In the news

Top-20 Cryptos See Major Losses, Bitcoin follows their lead

The crypto market witnessed a wave of red on Sunday, 22 September amid the impending launch of Bakkt’s physically fulfilled Bitcoin-BTC futures.

Bitcoin investor and entrepreneur Willy Woo believes that the current state of the market could be the start of a new bull market. Woo in a tweet on September 21, cited on-chain metrics as potential evidence suggesting closing up the opening act of the bull market.

As per a report by Fortune, the fresh wave of red on the market comes a few hours before the launch of Bakkt’s physically delivered Bitcoin futures which long-anticipated development.

Despite views on the success of Bakkt’s physical BTC futures launch being mostly divided among the crypto community, major crypto believer John McAfee supported the bullish trend over the launch of Bakkt. In a tweet on Sunday, September 23, McAfee revealed that the start would increase the level of trust by institutional investors and possibly jump-start crypto adoption.

BTCUSD: Technical Analysis

BTCUSD: Monthly Chart

As we come to the last days in September, the Bitcoin price heads south towards the monthly open of $9593.50, and still showing bearish outlook following an increase in selling pressure at the close of August. A bearish closing price within the high-low range (12325.0 – 9320.00) of August would mean a strong bearish trend in October.

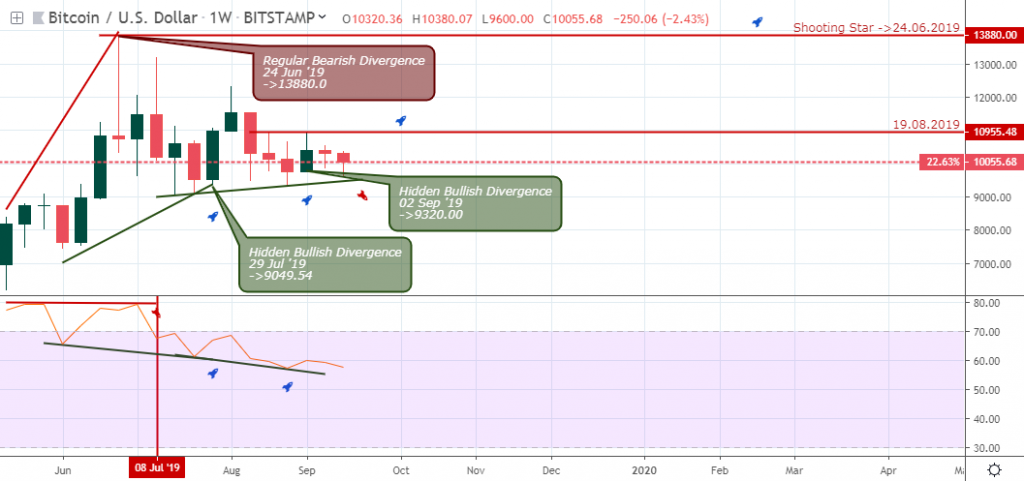

BTCUSD: Weekly Chart

Last week closed bearish signaling a rise in selling pressure alongside the double bearish resistance level setup at$10650.00 and $10955.48. If the Bitcoin to dollar exchange rate keeps closing within the high-low range of the previous week as we see last week on Singapore broker platforms, then there is a high possibility of the price traversing way lower.

BTCUSD Medium Term Projections: Bearish

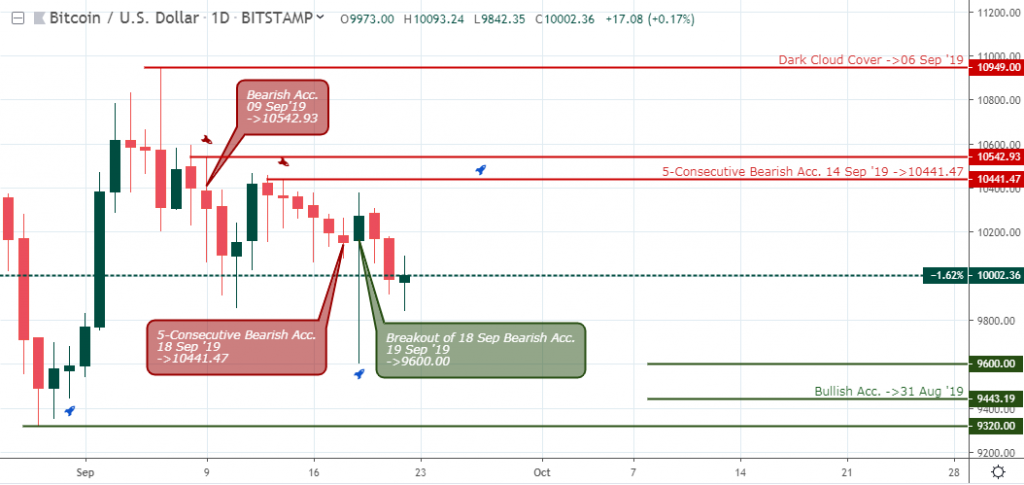

BTCUSD: Daily Chart

On the above daily time frame, the bitcoin price drops by roughly 6.8% from the dark cloud cover candlestick pattern and followed by short-sell re-entry levels on September 14 and 18. A sudden surge in bullish volatility closed as a Pin-bar candlestick pattern on Thursday, 19 September as the number one cryptocurrency trades with the pin-bar’s range.

BTCUSD: H4 Chart

The 4hour time frame signals a breakdown of significant support on September 06 16:00, followed by subsequent lower highs on September 08 08:00; 15 00:00; 20 04:00; 21 20:00; and 22 16:00.

The BTCUSD enters the oversold area while the price trades close to the monthly price open. We see an increase in the price similar to that of September 19.

BTCUSD Short Term Projections: Bearish

BTCUSD: H1 Chart

Zooming way down to the intra-day 1hour time frame, the bears seized the moment by closing below bullish threshold on Thursday 19. From that point on, selling pressure increased with the bulls being unable to see the BTC price closing above the significant resistance levels at $10180.43, $10034.51, $10073.26, and $9746.14 respectively.

A price close above the $9746.14 resistance will increase the chances of restoring the Bitcoin price to new highs, otherwise, we downward grind could persist.

Conclusion and Projection

The monthly and weekly time frames play a significant role in determining the trend of the BTCUSD, and the price slowly heads south. Recent decline in the Bitcoin BTC dominance in combination with the bearish technical patterns could lead to a further plummet in the price towards the $8000.00 region. However, if the price close above the $10380.07 resistance, the bulls may resume their campaign.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021