BTCUSD Outlook & Technical Analysis for Bitcoin

Contents

Introduction

Bitcoin BTC price has resumed a bullish trend, owing to two significant factors. First is an increase in miners’ reward.

Just like Central Banks in the traditional financial markets, Bitcoin BTC miners, in a way, control the price of BTC traded on Binomo platform.

With an increase in miners’ reward comes an incentive to hold on to Bitcoin BTC, which consequently leads to a rise in the price of the number one digital crypto asset.

The second reason for the hike in BTC price is the anticipated price surge that has historically followed all Bitcoin BTC halving of miners’ reward.

In this post, we’ll uncover significant technical chart patterns and interesting events driving the Bitcoin price upward.

BTCUSD Technical Analysis

Monthly Chart

At the closing price of the January ’20 candlestick, the Bitcoin to dollar exchange rate closed above the $7772.71 bearish resistance signaling an end to the prolonged six months price correction of USD based stable coins.

The new monthly chart setup is similar to the break of the December ’18 bearish resistance, as illustrated above.

Traders and investors, especially those on Singapore broker sites, seeing this price move, now resume their bullish outlook on the BTCUSD.

This move generally switches the market sentiment from bearish to bullish.

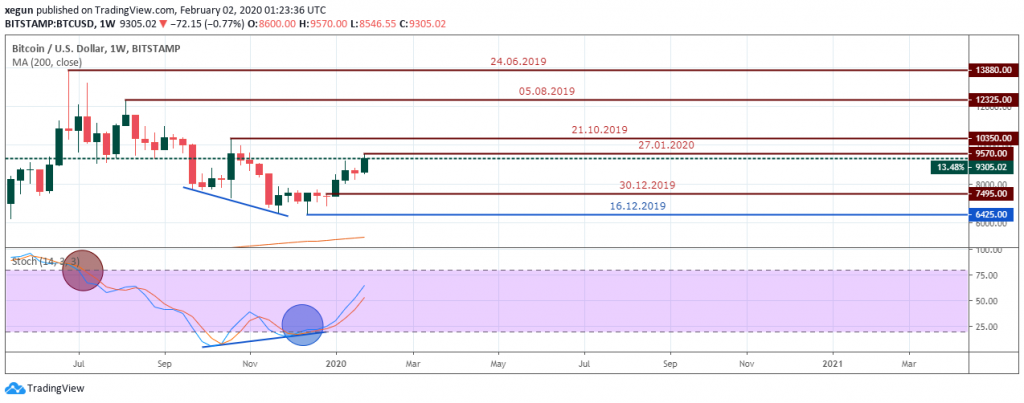

Weekly Chart

After a bullish price thrust above the bearish closing inside-bar resistance, the BTCUSD continued the bullish price rally and so far increased by about 5.6% from last week’s closing price.

The regular bullish divergence and recent break above crucial resistance level $9570.00, renews our confidence to scale into our existing long-only position.

Daily Chart

The regular bearish divergence resistance set up on January 30, 2020, failed to an increase in buying power on February 05, 2020, after using the MA-200 as a springboard.

The pair moved higher by 8.47% from the February 04, 2020 low at press time, confirming a bear-trap candlestick formation after closing bullish on February 05, 2020.

Notice an increase in demand for the Bitcoin BTC as it trades in overbought territory at press time.

Tom Lee: Bitcoin to Gain Almost 200% in The Next Six Months

Bitcoin (BTC) is set to gain almost 200% on the average over the coming half dozen months, according to Bitcoin’s big fan, Tom Lee.

According to Lee, January, which is notably a good month for Bitcoin has seen Bitcoin up 26% and also recovering its 200-day moving average. Anyone who follows trends knows that when BTC moves back above the 200-day moving average, the bull market is back, Lee explained.

What follows is for Bitcoin within its next six months whenever it breaks into the 200-day zone, according to Lee, is an average gain of 197%.

The 200-day moving average has traditionally symbolized the main area of resistance for markets.

Conclusion and Projection

The bulls now appear to be unstoppable as the BTCUSD price chart shows no bearish chart pattern as we enter the second of the first quarter (Q1) 2020.

From the monthly opening price, we look forward to a first price objective at $12325.00 and $13880.00, perhaps between Q1 and Q2 2020.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021