Traders are cutting their Dollar long positions this week ahead of the uncertainty surrounding the US Presidential election on November 8.

The Dollar pullback this week has a lot to do with the fact that investors simply don’t like uncertainty and since the market was net long on the US Dollar it was normal for traders to square off their positions. As a result EURUSD, GBPUSD and AUDUSD rallied while USDJPY fell during this week.

No major effects on the US Dollar or the Forex market are expected with either a Trump or a Clinton victory.

However, it’s worth noting that a Trump victory will bring increased uncertainty in financial markets and that could support the safe heaven currencies like the Japanese Yen and the Swiss Franc. Simply because he wants to introduce some radical changes.

A Clinton victory, on the other hand, should have only a minor impact on markets as this scenario is viewed as more probable and is already somewhat priced into markets. In addition, Clinton is also a continuation of the Obama policy so, no radical changes – no uncertainty in markets.

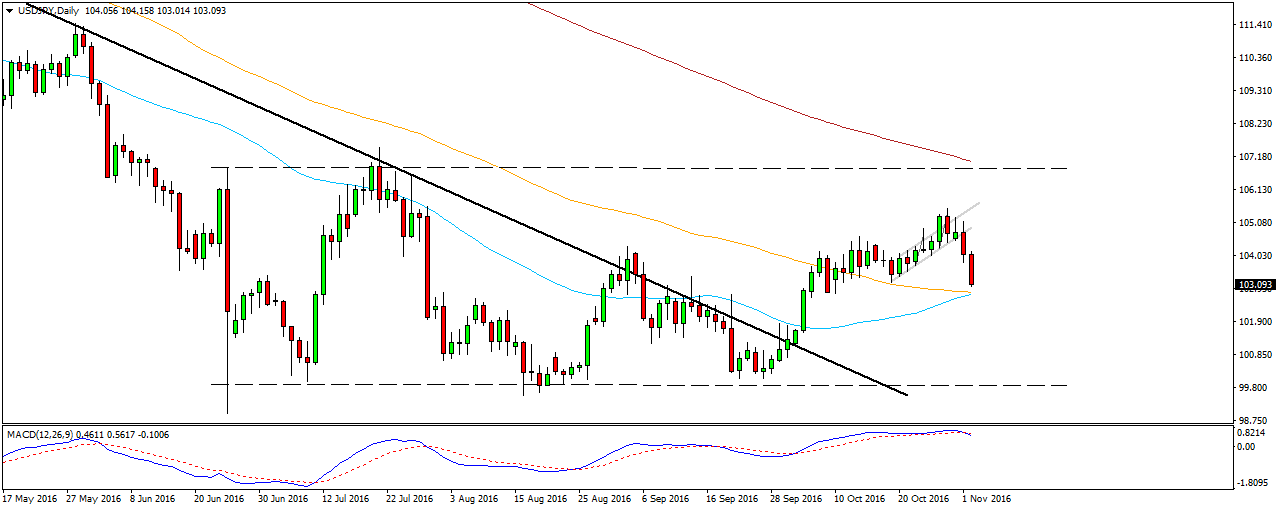

Traders should keep in mind that the result of the Presidential election is too close to call and a Clinton victory is not a sealed deal. So with that said traders should be cautious about a Trump victory as it will likely send the JPY higher across the board. That means that USDJPY will probably revisit the lows at 100.

USDJPY Daily chart – No support levels in sight until 100

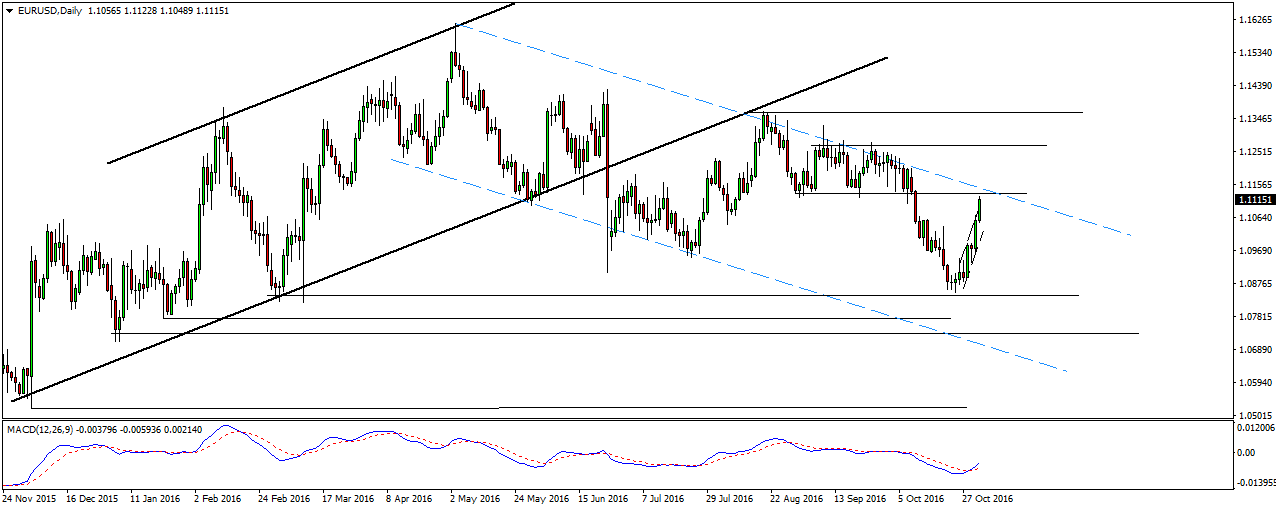

The EURUSD pair is approaching a confluence resistance zone at 1.1100 – 1.1150 and it’s unlikely that it will go higher at least until we get the results of the election. And even then it will still be hard for the pair to breach this area as it has rallied quite a lot since last week, so the uptrend is getting a bit overextended.

Under the circumstances, it would be recommended that US binary options traders consider selling EURUSD. At least technically, we can place a tight stop and target 1.0850 and 1.07.

The confluence resistance area is at the upper border of the channel. The lower border of the channel is currently at 1.07.

EURUSD Daily chart – The pair rallied this week and now it’s close to resistance

Our Recommended Binary Options Brokers to trade US Dollar:

Featured Broker Site: BinaryMate

- Trade Binary Options & CFD

- 24/7 Live Video Chat

- Quick Withdrawals

- Up to 100% Deposit Bonus

- Demo Account

- Weekend Trading

Best US Broker

- They accept US clients

- 1-Hour Withdrawal

- Paypal & AMEX Accepted

- $1 Minimum Trade

- Huge Bonuses

- Highest Returns

- Weekend Trading

- Free Education

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: us dollar • us presidential election