Weekly Analysis for Singapore Brokers

Contents

Based on a strong growth in the economy, Singapore is popularly known as the Asian Tiger. The Asian Tiger has had her economy strengthen against the United States Dollar since January 2017, and continued to maintain this strength until the end of December 2017. The New Year 2018 ushered a support level at 1.3008, leading to an upward rising oscillatory move. A handful of Singapore brokers present an opportunity to trade this pair as CFD or binary options. Brokers such as IQOption and Crypto Robot to mention a few are suggested brokers for your consideration.

Based on a strong growth in the economy, Singapore is popularly known as the Asian Tiger. The Asian Tiger has had her economy strengthen against the United States Dollar since January 2017, and continued to maintain this strength until the end of December 2017. The New Year 2018 ushered a support level at 1.3008, leading to an upward rising oscillatory move. A handful of Singapore brokers present an opportunity to trade this pair as CFD or binary options. Brokers such as IQOption and Crypto Robot to mention a few are suggested brokers for your consideration.

Taking a look at businesses and consumer sentiments which are considered major market movers, the Singapore economy is attractive for its free-market nature, as well as zero tolerance to corruption and stability in product prices. However looking at external factors that may put Singapore brokers and traders in a risk-averse position, Bloomberg commented on Singapore as – “Singapore dollar is considered Asia’s most vulnerable currency, following prospects of higher U.S interest rates”. This is an external impact on the price of the pair, which could lead to a weakening of the Singapore Dollar price.

Traders and Singapore brokers alike are placing more preference on the U.S. Dollar, owing to higher interest rates in the United States, a contracting construction sector and a shrinking external demand which contributes mostly to the strength of the SingDollar.

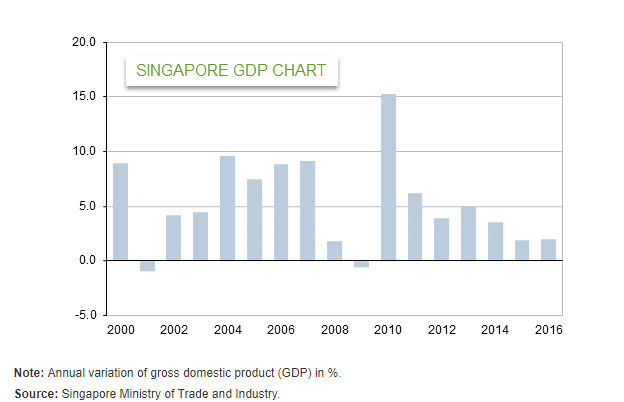

Singapore GDP

The Gross Domestic Product (GDP) of a country is a measure of the economic performance of that country, which could be quarterly or annually. This is considered a coincident driver /leading indicator which the central bank of a nation look out to increase interest rates and so on.

As shown on the GDP chart above, following a plummet of the GDP to about 0.6% in the 2008 recession, the GDP made a bounce back in 2010 to 15%. Moving forward, the Singapore GDP has been able to sustain a stable growth.

In Q4 the economic growth of Singapore went into a deceleration, due to contraction in the manufacturing sector based on an advanced estimate released by the Ministry of Trade and industry on January 2.

Technical Analysis

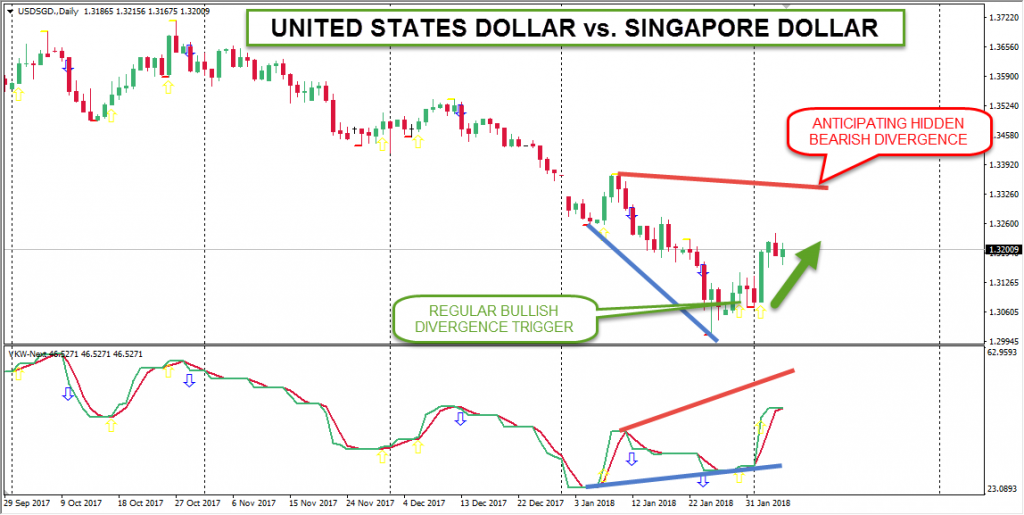

This week has been an upward moving rollercoaster for the pair USDSGD from the 4-hour time frame, where we expect to see new highs established. The upward move is based on a regular bullish divergence at the close of the day on the 30-01-2018, daily time frame as shown in the chart illustration below. A Singapore broker or trader can place a trade at the formation of this signal, and be in profit already.

USDSGD DAILY CHART: REGULAR BULLISH DIVERGENCE

USDSGD 4-HOUR CHART: SHOWING TAKE PROFIT ZONE

Conclusion

We remain bullish on the pair for the time being, based on the outlined technical setup on the daily chart and the United States exogenous fundamental reasons.

Though there is an upward bullish signal on the daily chart which is currently causing the upward move from a technical point of view. The pair is still in a very strong bearish monthly chart trend, where we expect to resume the move by a dead cross formation of the oscillator on the daily chart. I believe no Singapore broker or trader will want to Short all its holdings of the Singapore Dollar, giving the long-term prospects the nation’s economy presents. The image below shows the monthly trend and the divergence that led to the trend.

Our Recommended Singapore Broker & Robot to trade SGDUSD:

Best Regulated Broker: IQ Option

IQ Option is the world’s leading EU regulated financial broker based with a revolutionary platform for all traders. Very popular for binary options & crypto trading. Read IQ Option review

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $10,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 98%*

Best Robot for FX & Crypto: CryptoRobot

CryptoRobot is the most popular robot for cryptocurrencies. This software works great to generate profits in Bitcoin, Ethereum, Litecoin, Ripple, Dash and others cryptocurrencies.

- 100% Free Auto Trading Software For Cryptocurrency

- Free Demo Account

- Over 6 crypto brokers to Trade

- Download is Not Required

- High Accuracy

- 3 Trading Methods to Choose

- Up to 7 Indicators ( signals sources )

DISCLAIMER

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021