USDSGD Technical Analysis for Singapore Brokers

Contents

Introduction

How soon can this Covid-19 pandemic come to an end? OlympTrade traders want to know how soon its foreign exchange can compete favourably again in the market, how investors can remain in the market.

Singapore Fundamentals

The Monetary Authority of Singapore (MAS) has vowed to contribute adequate liquidity in the financial system to overcome the virus-induced crisis.

The negative interest rate is finding its way to Singapore because the nation’s overnight borrowing rate fell below two base points, falling below the year’s high of 1.68% in January.

What MAS does most is to manage her currency against the majors as a policy tool; the city-state’s borrowing costs tend to track the US benchmarks.

U.S. Fundamentals

Personal spending measures, we also know the ripple effects it will have on the economy when the consumer buying is on the rise; this is also known as consumer spending. The rate of expenditure during this pandemic will tell us the state of the US economy.

The Previous data released was -7.5%, and if the actual data to be released is greater than the Forecast -12.6%, it is good for the currency. However, if the outcome is lesser than expected, it is bad for the currency.

USDSGD – Technical Analysis

USDSGD Long-term Outlook: Bullish

Monthly Chart

Monthly Resistance Levels: 1.440, 1.46470

Monthly Support Levels: 1.41078, 1.34435, 1.32854, 1.30088

The USDSGD has kept its bullish trend form for the past months after it established its support from the 1.34405 level.

The resistance level of 1.46470 could not push the price below the 1.41078 level before losing it to the bulls.

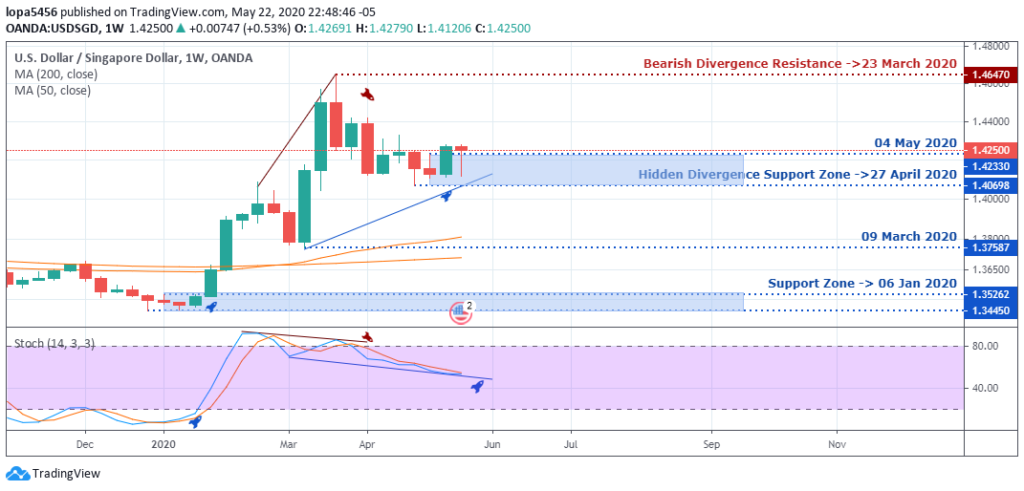

Weekly Chart

Weekly Resistance Levels: 1.46470, 1.440

Weekly Support Levels: 1.35262, 1.34450, 1.37587, 1.40698, 1.42330

From the rejection of price that took USDSGD down after the bearish divergence of 23 March 2020, we can see that for some weeks, the price fell into a range.

After some weeks, it established a hidden bullish divergence on the support zone of 1.42083, pushing the price higher and exposing the 1.46470 level.

If the bulls can sustain the pressure, we may continue to see a rise in price in the coming weeks.

USDSGD Medium-Term Outlook: Bullish

Daily Chart

Daily Resistance Levels: 1.43295, 1.44193, 1.46520

Daily Support Levels: 1.40698, 1.37587

The USDSGD price has broken above the trend line that connected the Chuvashov’s fork resistance of 06 and 21 April 2020 resistance, respectively.

The bullish divergence of 30 April 2020 broke out above the trend line resistance as the bulls rally increases.

H4 Chart

4Hour Resistance Levels: 1.42597, 1.42797

4Hour Support Levels: 1.41098, 1.41206, 141390, 1.41616

Bearish divergence took the USDSGD from the resistance (1.42797) to the support level of 1.41208 in which the bears were in control. A bullish divergence was spotted at the end of the bearish run and confirmed with the stochastic.

After a series of rejections, the price finally broke above 1.41390 and later advance to 1.43597. Should the momentum continue, the 1.42965 zones will be exposed.

Bullish Scenario:

A general bullish scenario is in play based on the H4 time frame, and it is in line with the primary direction of the trend. A close above the current resistance will attract more buyers.

Bearish Scenario:

Singapore brokers are watching the psychological zones on the USDSGD chart amid the COVID-19 outbreak. Can the bears push back the price in the coming days? We shall know the outcome as events unfold during the trading week.

Conclusion

The Singapore brokers are kin to know the state of its foreign exchange amid the Covid-19 pandemic and how its economy is recovering.

Governments of both nations are taking measures to reopen various sectors so that the activities will bringing businesses back to life and perhaps reduce the global unemployment rate.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021