USDSGD Technical Analysis for Singapore Brokers

Contents

Introduction

All through last week on top Binomo broker , we see an increase in the value of the Singapore dollar traded against the USD.

This week, however, the Greenback starts to show strength as the pair enters into the area of previous buyers’ accumulation levels.

Will the initial hints of recovery in USD sustain or return to a collapse in the exchange rate? Let’s examine the charts.

Singapore Consumer Price Index (CPI)

The Consumer Price Index (CPI) is an evaluation of any variations in the price of goods and services from the consumer’s perspective.

The CPI is a major way to evaluate changes in purchasing trends and inflation and can have a positive or negative impact on the currency.

A surge in CPI may increase interest rates and cause growth for the local currency. However, during a recession, a rise in CPI may deepen the recession and therefore cause a fall in local currency.

Most recent data released November 25 suggests a positive outlook for SDP with the previous and forecast readings at 0.5%, while the actual reading is 0.4%.

U.S. Core Durable Goods Orders

Core Durable Goods Orders is an evaluation of the change in the total value of new orders for long-lasting manufactured goods, except transportation items. Higher data reading means improved manufacturing activity.

We can look forward to a bullish sentiment for the USD if the reading is higher than anticipated. However, we can conclude that the trend is bearish for the USD if the data reading is lower than forecasted.

Most recent data released October 24 points to a positive outlook for USD with the actual data reading -0.3%, and previous readings at 0.3%, while the forecast reading is -0.2%.

USDSGD Technical Analysis

USDSGD Long term Projection: Correction Phase

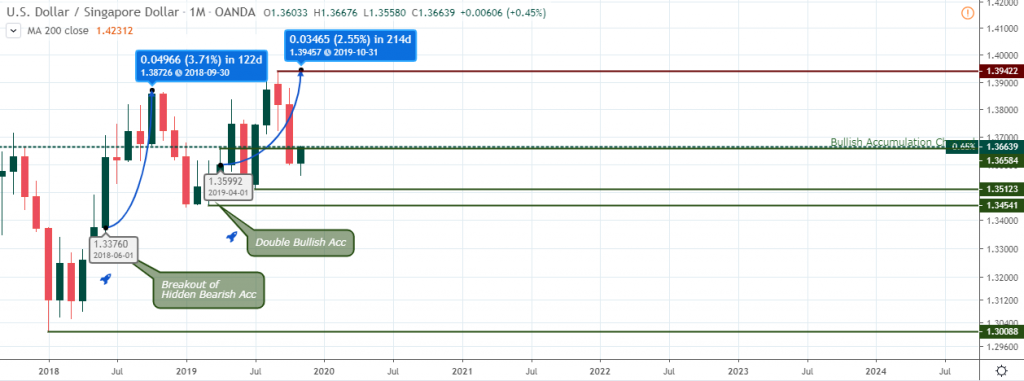

Monthly Chart

A break above resistance on June 01 ‘18 was the first buy setup into the USDSGD. The price increased by about 3.71% from the breakout point and corrected the gains after setting a high of 1.38726 on September 30 ’18.

The bulls gathered on April 01 ’19 and hiked the price up again by 2.55% after confirming an end to the correction with an accumulation signal (bullish).

Let’s move a step lower to the weekly chart and see if we can get an early signal for a bottoming.

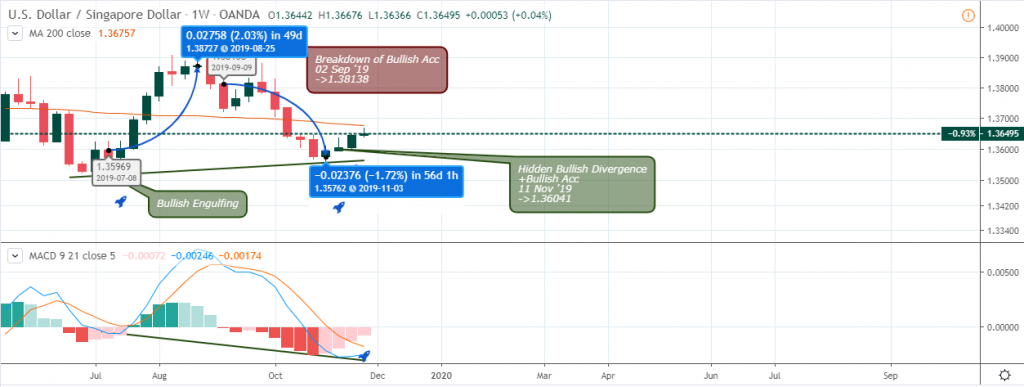

Weekly Chart

The above weekly chart illustrates the bottoming after a 1.72% slump in price from a collapse of support on September 09 ’19.

Notice the accumulation pattern (bullish), confirming the impending hidden bullish divergence pattern on November 11 ’19.

The 200-weekly Moving Average happens to be the impending force on the further advancement of the exchange rate. A close above this level currently at 1.36757 is a signal to scale into our long position.

USDSGD Medium Term Projections: Bullish

Daily Chart

The bottoming is confirmed as you can see on the chart above, this time with a regular bullish divergence pattern established by a breakout pattern on November 06 ’19 and immediately signaling a buy order at 1.36006.

A bullish re-entry signaled was initialized on November 19 after the accumulation of buy orders at 1.36090.

Conversely, the 200-daily Moving Average is a perfect take profit level for this pair as the USD to SGD is already trading below the daily open price at publication time.

H4 Chart: Bullish

Viewing from the 4hour chart perspective, the USDSGD foreign exchange rate broke below support on November 14, 14:00, and drops by 0.18%.

There was no clear set up to enter a long position till November 21 ’19 14:00 after a price close above significant resistance and then signaling a buy order at 1.36282.

A collapse of the bearish-inside bar pattern is set at press time, and the pair may hit the MA-200 before resuming the bullish campaign.

Conclusion

We should expect a slowing of the price rally, hence, a perfect time to take profit from our long order.

The 200-day Moving Average is a crucial level in determining a further price hike or correction.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021