BTCUSD Outlook & Technical Analysis for Bitcoin

Contents

Introduction

With no improvement in the Bitcoin BTC miners’ reward, the bearish trend of the BTCUSD crypto pair continues on IQ Option platforms.

However, a sudden burst in demand for the number one crypto is seen at press time.

Should we expect further price decline in the BTC price as we come to the end of the year? Let’s analyze the chart for deeper insights and consider some interesting news events in the space.

BTCUSD: Technical Analysis

Weekly Chart

Resistance: $10380.07, $9586.50, $7772.71

Support: $7087.09, $6515.00

The Bitcoin BTC paired against the USD sees a sudden price surge to the upside at press time, showing the strength of the bullish support $7087.09 above.

Let’s proceed to the daily time frame for more insights into the price build-up, perhaps we may see the triggers that led to the recent price hike.

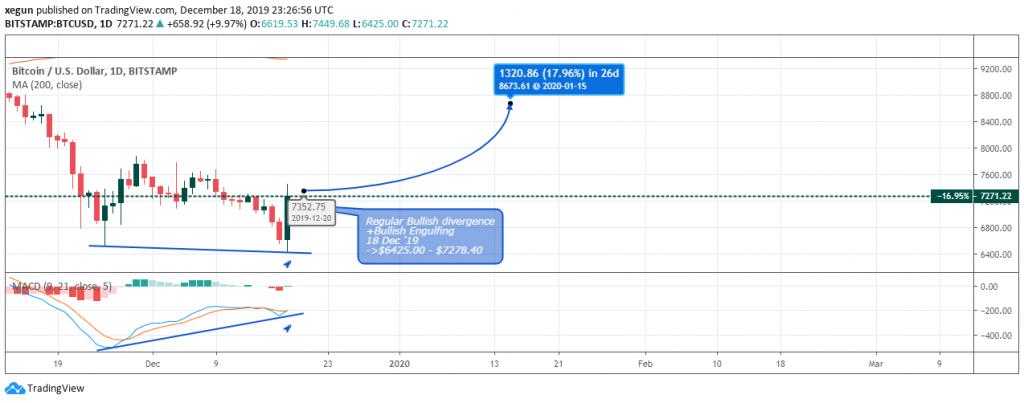

Daily Chart

Resistance: $8631.60, $8231.04, $7870.35, $7772.71, $7618.99, $7296.19

Support: $6515.00, $6425.00

The above daily time frame shows the Bitcoin to Dollar price projected to plummet south by about (-23.27%) from a collection of sell orders on November 20 ’19.

A regular bearish divergence pattern signaled at publication time stresses the strong possibility of a trend reversal from bearish to bullish.

Below is an illustration of the regular bullish divergence setup.

The regular bullish divergence above is similar to that of October 25 ’19 following the statements uttered by the Chinese president Xi Jinping.

Like the October 25 ’19 price surge, we may expect a counter decline in Bitcoin price, if there is no improvement in miners’ reward.

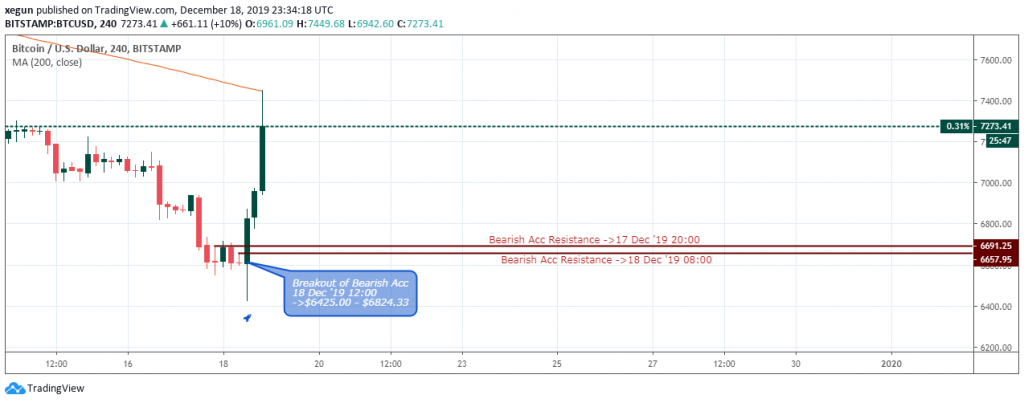

4Hour Chart

Resistance: $7772.71, $7563.00, $7618.99

Support: $7087.09

Finally, on the 4hour time frame, the bearish resistance on December 17 ’19, 20:00 gave in to a sudden increase in buying power, leading to about 9.21% price increase as illustrated below.

The 200-period Moving Average offered a timely resistance and took a profit target for the bullish price surge. A price close above the MA-200 should reinforce the bullish presence with the next target somewhere around the $8K round-number resistance.

Bitcoin Fundamentals

Coinfloor to Delist All Cryptocurrencies Barring Bitcoin

UK-based cryptocurrency exchange Coinfloor has announced that by January 2020, it will remove all cryptocurrencies from their list besides Bitcoin (BTC).

In a blog post on December 17, the exchange revealed that it would delist all digital currencies on January 03, 2020, in conjunction with the 11th anniversary of Bitcoin’s launch. The company plans to focus on Bitcoin only services in January.

The company’s CEO, Obi Nwosu, said the transition by Coinfloor is in line with the company’s vision to concentrate on cryptocurrencies that have stood the test of time.

Conclusion and Projection

To conclude, the Bitcoin price on Singapore broker sites will have to close below the $7087.09 support level on the weekly time frame for us to see the price enter the projected price range of $6000.00 – $5000.00.

However, an improvement in miners’ rewards may change the market outlook to a bullish swing without the price entering the $6K to $5K range.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021