BTCUSD Forecast for BTC

Contents

Introduction

The rate at which the US dollar has lost its value in the finical market has forced crypto brokers and other hedge funds managers to accept bitcoin as an alternative portfolio for investment.

However, Elon Musk, Tesla CEO sends a bearish sentiment into the Bitcoin ecosystem. Let’s see how that affects the BTCUSD going forward.

BTCUSD Technical Analysis

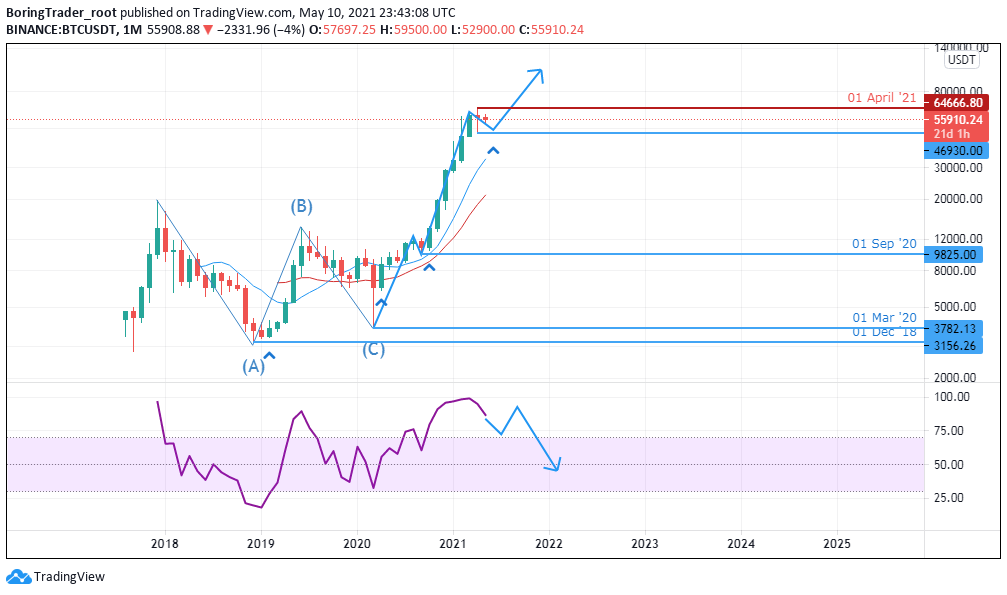

Monthly Chart

Monthly Resistance Levels: 64666.80

Monthly Support Levels: 46930.00

The BTCUSD pair is gaining a lot of acceptance as more firms are now adapting bitcoin payment into their system. This acceptance has kept the coin in a healthy bullish state having survived the global pandemic that is affecting the fiat currencies.

If the Bulls can close above the recent resistance level of 644666.80, we shall see the bitcoin increase in value attracting more buyers into the market. However, if the bullish run is unsuccessful, we may see a major correction phase on the monthly chart.

Weekly Chart

Weekly Resistance Levels: 64840.00

Weekly Support Levels: 46966.2, 29254.1

The weekly time frame shows that the price of bitcoin has not gone out of the range channel it created about seven weeks ago. For a deceive action to be taken, the price has to either break out above the resistance levels for a bullish run or it breaks down below the support zone of 46966.2 on the chart for a short position.

BTCUSD: Daily Chart

Daily Resistance Levels: 64899.00

Daily Support Levels: 50591.38, 47044.01

After days of consistent drop in the value of bitcoin, the BTCUSD pair could recover from the fall that push it to 47044.01. The Bulls have been trying to push back the price up since the beginning of May.

At the time of this report, the bullish run has not been sustained to close above the resistance level, however, if the Bears can reject the bulls advance, we are likely going to see a spike to the low of 50591.38 zones.

BTCUSD: H4 Chart

Four Hour Resistance 59516.77

Four Hours Support 52826.71

On the four-hour time frame, we can see that the price of BTC/USD was rejected strongly from the 559516.77 resistance zones by the bears and they have pushed the price down to the support levels of 52826.71 levels.

Recently we have seen the bulls push back strongly from the support levels as we expect long position traders to buy from the deep of the market.

The stochastic indicator on the chart shows that the price is expected to rise from the low of 52826.71 for a rally towards the resistance area.

A close above the zone will mean another rally for the bulls, but a failed attempt will attract more sellers and online brokers to sell off bitcoin.

Bullish Scenario:

The week can start on a bullish run as bulls are willing to push price for a retest of the daily resistance. A close above will open the way for more long position traders and investors.

Bearish Scenario:

For the Bears to dominate the market we need to see the bulls failing to take out the resistance levels giving the sellers an opportunity to open short positions from the zones.

Bitcoin BTC News Events

A Bigger Growing Trend

The general acceptance of cryptocurrency by bigger companies has started blowing up with new online brokers accepting bitcoin as means of payments. Ethereum Hotel in China is accepting digital currency also the likes of Tesla the tech giant.

Investors are also storing some of their wealth into cryptocurrencies so that they don’t miss out on the bigger wave coming into the financial world.

However, some individuals and firms are yet to accept the recent development in cryptocurrency which may become expensive not to include bitcoin as a payment option because of the cost of hiring cryptocurrency terminals.

Recently, Palantir a major software and analytics company added BTC to its payment method and will include it into its balance sheet. In Asia, DBS private bank is the first Bank to provide crypto trust services that provide custody and trading in Singapore.

The Bank will be offering its clients the opportunity to invest and manage about four digital assets including bitcoin which are hosted on banks digital asset exchange. The bank also provides fiat trading pairs on the exchange such as the Singapore dollar, Japanese yen, U.S dollar and Hong Kong dollar.

The development has added to the levels of legitimacy to cryptocurrencies within the region and it will encourage other investors who are interested in investing in the digital assets they consider safe. DBS Bank also provides tokenization of securities and other assets including bank-grade custody for digital assets.

Conclusion and Projection

The state of the bitcoin market remains bullish despite the bear market patterns it has displayed in recent time. Some analysts observed that bitcoin bulls usually round up their trade with marks of increased parabolic price action before a blow-off top happens and there is a pullback in demand.

However, the pattern is happening that way, rather, capital is accumulating massively at an increased rate on-chain volume. Based on the on-chain metrics you will notice the spike in dormancy, as old coins are sold off by weak hands to stronger hands.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021