BTCUSD Outlook & Technical Analysis for Bitcoin

Contents

Introduction

Bitcoin brokers are eyeing the peak of bitcoin with the hope of seeing their BTCUSD investment hit the top of 138880.00 before the year runs out.

Read on as we unveil the significant chart patterns on the BTCUSD for this week and into the quarter.

BTCUSD: Technical Analysis

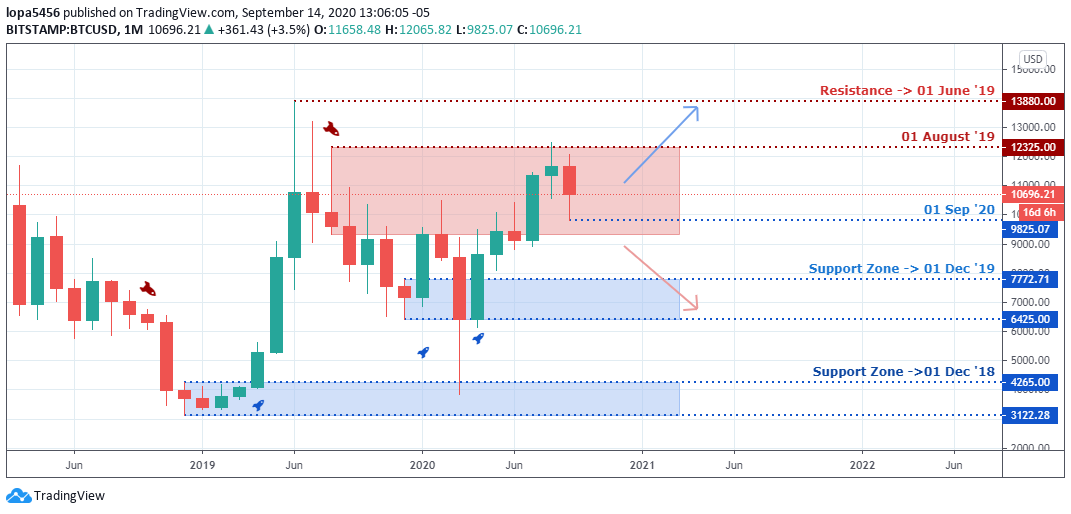

Monthly Chart

Monthly Resistance Levels: 13880.00, 12325.00

Monthly Support Levels: 3122.28, 9825.07, 7772.21, 4265.00, 6425.00

As you can see, the July candle’s bullish run was slowed at the resistance zones of 12325.00, which attracted the sellers that pushed back the bitcoin price in this new month.

The resistance zone is a psychological zone for sellers and buyers trading bitcoin because a close above will be a positive sign for investors to surpass the 13880 levels. At the same time, some investors hope to cash out of the portfolio, having noted the point of previous rejection of bitcoin price.

A close below the 9825.07 zones by the bears will expose the 7772.71 support levels.

Weekly Chart

Weekly Resistance Levels 13858.37, 12475.91, 12000.00

Weekly Support Levels: 6472.26, 3901.25, 10699.94, 10517.20.

A break above the resistance of 12475.91 will mean that the bullish surge stills continue having closed above the previous resistance zone of 10699.94 that may serve as support should the buyers have control of the market and the hidden bullish divergence should playout.

However, the bearish weekly candle may have collapsed the support level giving it room for another bearish drop after a retest of the 12000 levels as the week progresses. A close below the deck will expose the 6472.26 zones.

Daily Chart

Daily Resistance Levels: 12486.61, 12086.00, 10691.00

Daily Support Levels: 9126.12, 8815.01, 10000, 11200.00

The daily time frame shows the Bears are in control of the market because they could push the bitcoin price below the 11200.00 support zone. The bitcoin was ranging for some days after the strong breakout; the swing’s correction may not last long before we get another bearish swing that will close below the 1000 levels down to the 8815.01 zones.

The Buyers can take back control of the market if their momentum can rally over the resistance zones of 12486.61 and 12086.00 successfully for it to attract the Singapore brokers.

H4 Chart

H4 Resistance Levels: 11155.32, 11479.96, 12065.82, 10691.16

H4 Support Levels: 9850.00

A clear bearish trend can be seen from the four-hour time frame, having pushed down the bitcoin price from the high of 12065.82 down to the support zones of 9850.00 where it is resting.

To see the trend’s continuation, we need the bitcoin price to close below the 9850.00 showing more sellers.

However, the Bitcoin price struggles to go beyond 10691.16 zones if it must go up, and a break above the 11479.96 will mean that the buyers are in control of the market.

Bullish Scenario:

We expect the current support to push back bitcoin’s price towards the resistance zone of 11479.96 in the coming days from the four hours-time frames.

Bearish Scenario:

A bearish scenario is at play from the daily time frames and H4 as we expect a continuation of a downtrend if the bulls fail to go beyond the resistance zones of 11479.96.

Bitcoin BTC News Events

The MicroStrategy board recently had a vote, and it was agreed that the company’s reserve asset would be in bitcoin. This move will make the company’s cryptocurrency holding sore over the initial value equivalent of 21,450 BTC.

The MicroStrategy management believes that Bitcoin is the most accepted cryptocurrency in the world and a long-term attractive investment asset than holding cash.

The company’s move has led many smaller companies to follow a similar process to have their Bitcoin reserves. MicroStrategy is a company that has attracted big institutional investors, and they have a stake in the organization.

Conclusion and Projection

As the year is approaching its last quarter, the Singapore brokers and other investors are looking at the possibility of taking their profit, which may affect bitcoin’s price in the nearest future.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd