BTCUSD Forecast for BTC

Contents

Introduction

Bitcoin sets a new ATH on all crypto platforms, and starts a bearish campaign in the last weeks of January. Are we seeing the start of a total change in trend polarity from bullish to bearish, or is this simply a price correction?

Read on as we uncover the chart patterns and news events driving the BTCUSD exchange rates.

BTCUSD Technical Analysis

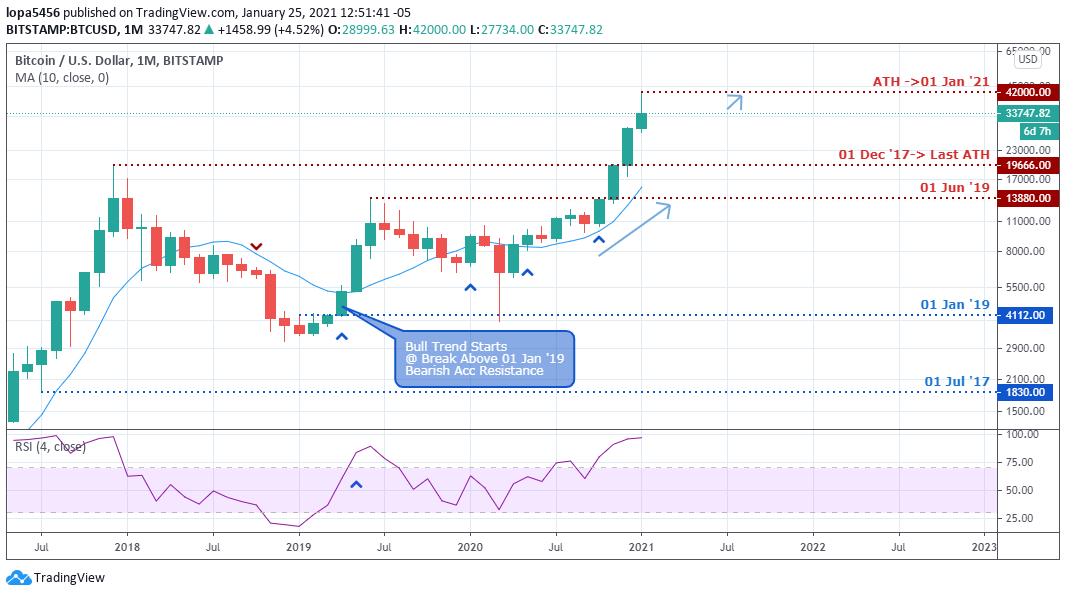

Monthly Chart

The Bitcoin exchange rate corrects by about -27% from its all-time high and trades close to the monthly open price in January.

Analysts speculate on the recent price decline being an effect of profit-taking by miners and investors.

Weekly Chart

An accumulation of sell orders is revealed after last week’s closing price, indicating the likelihood of a price slump below the MA10 and towards the 24.5K area.

A bearish price close below the 28850USD price level from last week will signal a confirmation to jump in on the bullish train.

Daily Chart

On 21 January ’21, the bears forced a hidden bullish divergence break, highlighting the Bitcoin bulls’ further weakness.

Regular bearish divergence setups on 08 January ’21 already showed that BTC whales and miners might start moving out their BTC profits.

We may see a continuation of the up move if the BTC/USD exchange rate soars above the bullish divergence trend line.

Bullish Scenario:

We anticipate a further price slump below the 30K mark before considering going all-in towards the upside.

Meanwhile, following a dollar-cost average lot allocation, traders can consider scaling in right away on the spot market.

Bearish Scenario:

Although the general BTC market sentiment points to the upside, intraday traders may consider taking quick short-sell entries with tight stop loss, as the BTC price could still do a sharp plunge below the MA-10 on the weekly-TF.

Bitcoin BTC News Events

A Reston, Virginia based software development service company, Sequoia Holdings, a different company from Sequoia Capital (Venture Capital Firm), recently offers its staff the option of putting aside a part of their salary towards investment in cryptocurrencies.

The company, which is modeled as an employee-owned firm, suggests integrating cryptocurrencies into employee salaries could improve staff sentiment.

Sequoia Holdings Employees can choose to differ a part of their salary and invest it in one of BTC-Bitcoin, ETH-Ether, or BCH-Bitcoin Cash.

Unlike the popular US employee 401K retirement savings, the crypto investment from part of the client fund is calculated following tax deductions.

Analysts recently speculate on a likely reset of the equities market amid claims of a wavering interest in institutional BTC-Bitcoin.

The week started with the 30KUSD mark as significant support and a possible decline in confidence from the mainstream.

Starting with Hong Kong, a favorite among Chinese investors, the stock market showed a sound upward momentum on Monday.

The bullish sentiment was ignited by a 1.9trillion USD coronavirus stimulus package by US President Joe Biden earlier this month.

GMO Asset management CEO Jeremy Grantham gave warnings of stocks being in a bubble, and a stimulus injection would only worsen things. He projected that the current stock market rise could last about two weeks.

Nikolaos Panigirtzoglou of JPMorgan Chase also warned that a decrease in demand for GTBC – Grayscale’s Bitcoin Trust implies that the upward momentum of the number one crypto by market cap is unlikely.

The Reserve Bank of India is reported to now explore the likelihood of a digital currency almost a year after the overturn of the crypto business ban by the Indian Supreme court.

Conclusion and Projection

The RSI indicator’s chart structure hints that we should get set for a possible slump in the BTC price, after which we’ll buy into the upcoming upbeat trend.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021