BTCUSD Forecast for Bitcoin

Contents

Introduction

The presidential election is an exciting period for the online brokers in Singapore, as investors, traders, and institutions pay attention to the developments going on around the US election and how to keep their investment safe during the aftereffect of the result.

BTCUSD Technical Analysis

Monthly Chart

Monthly Support Levels: 11000.00, 4650.00

The month of October ended with a bullish candle at the resistance levels. The stochastic indicator signal line is in the overbought region, indicating that bitcoin is overpriced, and we expect the value to drop sometime soon.

A close above the 20000.00 level will mean a total breakout for a new high in bitcoin history.

However, if the price respects the resistance zone, we shall see a double top pattern, which will mean a reversal of the trend from an uptrend to a downtrend; we expect the price to swing towards the low of December 2018.

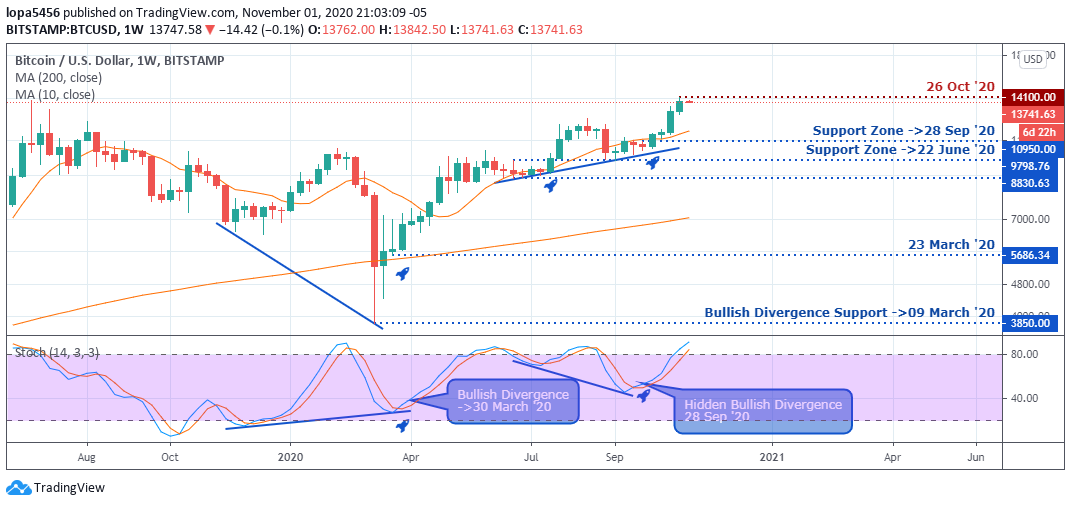

Weekly Chart

Weekly Resistance Levels: 14100.00

Weekly Support Levels: 10950.00, 9798.76

From the weekly charts, you can see the previous week’s candle sitting on the resistance zone, which will either break through the levels or gets rejections from the zones.

Although the BTCUSD maintains an excellent positive outlook, online brokers should wait for a clear direction from the chart as the US election will influence the BTC/USD.

If we get a bullish surge above the 14100.00 levels, the trend will continue to go up, while a strong rejection with bearish engulfing candles will mean that the price of BTCUSD is going to reverse from the resistance level for a downtrend.

Daily Chart

Daily Resistances: 14098.92

Daily Supports: 13261.00, 12486.61

The BTCUSD long position traders were able to push the price above the 17th August 2020 daily chart’s resistance level to become future support for bitcoin. The bulls will have to close above the 14098.92 levels if they must continue the rally.

However, a close below the the13261.00 will push the price down to the previous resistance turned support if the current resistance proves healthy.

H4 Chart

our Hours Resistances: 14101.46

Four Hours Supports: 13748.06, 13729.08, 12734.33

The Bulls bullish momentum dropped, and bitcoin’s price had been ranging for a while without a specific direction after making a high of 14101.46.

The online brokers will have to wait for the price to make another higher high to continue a bullish trend, or they wait to see if the low of 13748.06 will be taken out, which may drop to the 12734.33 support level.

Bullish Scenario:

A general bullish scenario has been trending from the daily time frame, and we expect it to continue if the price can close above the 14101.00 resistance levels for another bullish swing.

Bearish Scenario:

A general bearish scenario based on the four-hour time frame builds up gradually as we can see the loss of bullish momentum from the chart. A close below the 13729.08 levels will attract more sellers into the market.

Bitcoin BTC News Events

Some years back in 2008, 31st October, Satoshi Nakamoto published a nine-page paper about a BITCOIN new payment system.

This technology has survived for the past 12 years and evolved into advanced technology like blockchain.

For others, they see bitcoin’s advancement beyond the financial aspects, that the white paper should be considered a breakthrough in technology like the internet and PC.

Satoshi proposed an electronic payment system that’s based on cryptographic proof, consequently replacing a trusted entity.

The above thought was why the P2P or digital cash system was created 12 years ago to exclude the third party involvement.

However, some persons see the objectives of Satoshi Nakamoto to be having some challenges with the central banks as they plan to lunch their cryptocurrencies, and the high numbers of mining pools are on the increase.

Also, the primary purpose of the bitcoin transaction of peer-to-peer trading has been taking over by an intermediate centralized exchanger that has led to the objectives’ disappointment.

Conclusion and Projection

The US election is an influencer to the volatility of BTC/USD in the coming days; it is best advisable for traders and investors to stay safe from the market until the election comes to an end.

The BTC/USD pair is not trending now until we get a significant breakout either to the upside or downside of the market in the coming days.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd