BTCUSD Outlook & Technical Analysis for Bitcoin

Contents

Introduction

The Singapore brokers are watching the current structure for bitcoin’s specific direction. They can remember the crisis in KuCoin, where the Singapore-based exchange was defrauded over $190 million of customers fund when it was hacked in September last year.

The CEO has pointed out a possible suspect while awaiting the official reports from the police.

BTCUSD: Technical Analysis

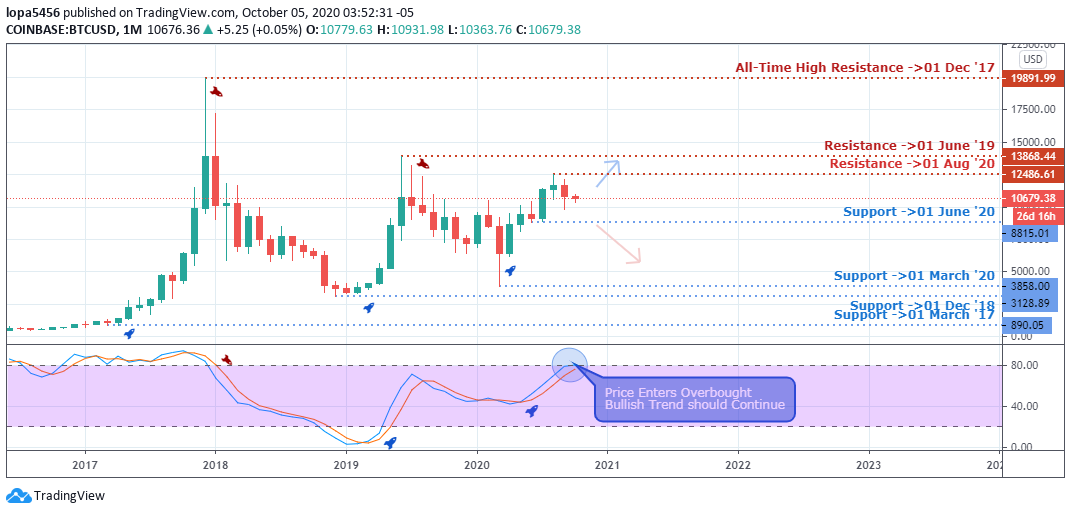

Monthly Chart

Monthly Resistances levels: 19891.99, 13868.44, 12486.61, 10679.38

Monthly Support levels: 8815.01, 3858.00, 3128.89

The price of BTDUSD has not gone above the resistance zones of 12486.61 and 13868.44 since it broke above the resistance levels 10679.38 with a strong marobuzu candle as of July.

If the bullish momentum is lost, we may begin to see more sellers in the market, placing a short position for a downtrend bias as Singapore brokers and other traders are taking their profit around the resistance levels.

However, should the price of bitcoin break above the 12486.61 levels with a close, it will attract more buyers in the market for another swing high towards the 19891.99 levels.

Weekly Chart

Weekly Resistance Levels: 12473.00, 10933.26

BTCUSD Weekly Support Levels: 10690.26, 9825.07, 3850.00

Bitcoin’s value is struggling to close above the 10933.26 resistance levels, having seen a rejection of price at the 12473.00 so weeks ago.

The hidden bullish divergence of 07 September 2020 will have to close above the 12473.00 resistance levels to have its course because of the bearish candle that signals the Bears pressure at those zones.

The resistance levels are highly dominated by the sellers, which might be that most traders with long positions are taking profits, and now they have to take a short position for 9825.07 targets and below in the coming weeks.

Daily Chart

Daily Resistances: 12473.00, 11771.44

Daily Supports: 10667.53, 9825.07, 9343.49

On the daily chart, we can see that the bitcoin market is in a downtrend, having formed a failure swing from the resistance levels of 11771.44 and 12473.00, respectively.

After the two days of substantial drops, it went into range. If the downtrend continues, the price needs to close below the 9825.07 level to expose 9343.49 levels.

We observe the bulls trying to push the price of bitcoin high from 10667.53 levels to the 11771.44 at press time, should they have the momentum in the coming days.

H4 Chart

Four Hours Resistances: 12065.82, 11479.96, 11155.32,

Four Hours Supports: 10680.00, 9850.00

The Bears have the dominance, having rejected the Bulls’ retest at the 11155.12 level pushing back their attempts. The Bears need to overturn the current zone of support 10646.75 into resistance to overpower the Bulls.

However, the Bulls are also in contention for another push towards the previous resistance levels to drive against the Bear’s dominance as the events unfold.

Bullish Scenario:

The bulls may have bullish scenarios on the four-hours and daily time frames as they plan to dominate and control the bitcoin market if price can find support around 10669.00 for an upward surge.

Bearish Scenario:

The weekly time frame shows a bearish scenario and a pointer of a trend reversal in weeks to come based on the chart pattern it has shown. If resistance should hold, we will likely see more sellers coming in from the four-hour time frame.

Bitcoin BTC News Events

Sometimes, last year, KuCoin was hacked, and customer’s funds were stolen, and recently in the USA, some groups of individuals were charged with illegal operating derivatives exchange. There are about five entities fined, including BitMEX CEO, by the U.S.

Commodity Futures Trading Commission (CFTC), having to violate the Anti-Money Laundering regulations for operating an unregistered trading platform, was charged about 45,000 BTC that was withdrawn from BitMEX.

Conclusion and Projection

The Institutional traders, OlympTrade investors, and Singapore brokers observe bitcoin’s reaction and how it will react during the presidential elections and the allegations against five entities charged for money laundering.

As the new week unfolds, we expect BTCUSD price to break out of the symmetric triangle on the daily timeframe for more precise direction for the Singapore brokers.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd