BTCUSD Outlook & Technical Analysis for Bitcoin

Contents

Introduction

The rise of COVID-19 second wave brings uncertainty in the market and consequently translates to more risk for OlympTrade traders and other investors. However, with risk comes volatility, which presents opportunities for huge profits.

Let’s look at the charts.

BTCUSD: Technical Analysis

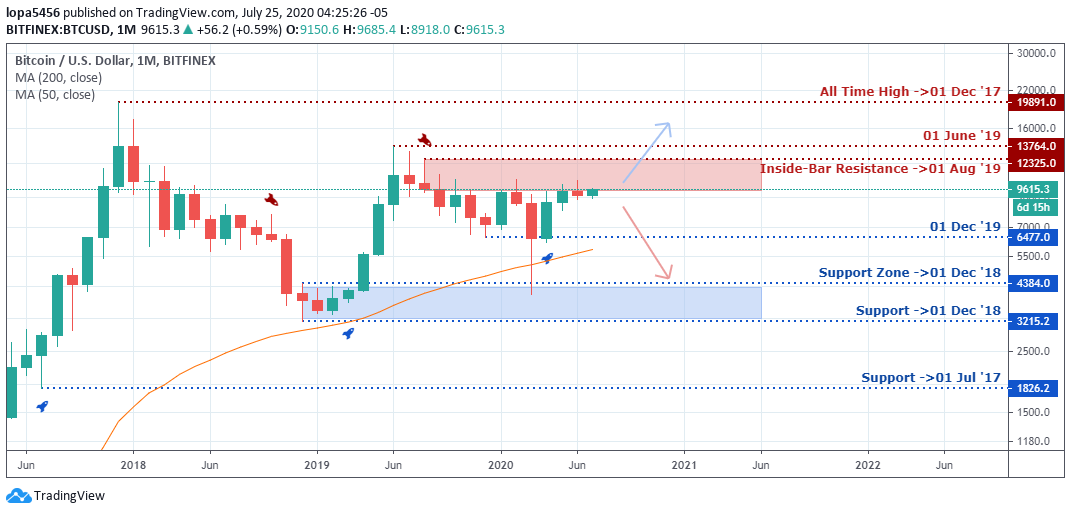

Monthly Chart

Monthly Resistance levels: 12325.0, 13764.0, 19891.0

Monthly Support Levels: 1826.2, 3215.2, 4384.0, 6477.0

We see a massive surge in bullish momentum in these last weeks of the month. The bitcoin price is approaching the resistance zone of 01 August 2019, which built up an inside bar resistance at the 12235 levels.

Can the bulls succeed to take the price higher above the 13764.0 resistance, or will the bears’ have the upper hand to push back the bitcoin price to 6477.0 the support level of 01 December?

In the coming months, we shall know if the resistance level turned support of 01 December 2018, and the support level of 01 December 2019 will aid the bullish surge above the resistance levels.

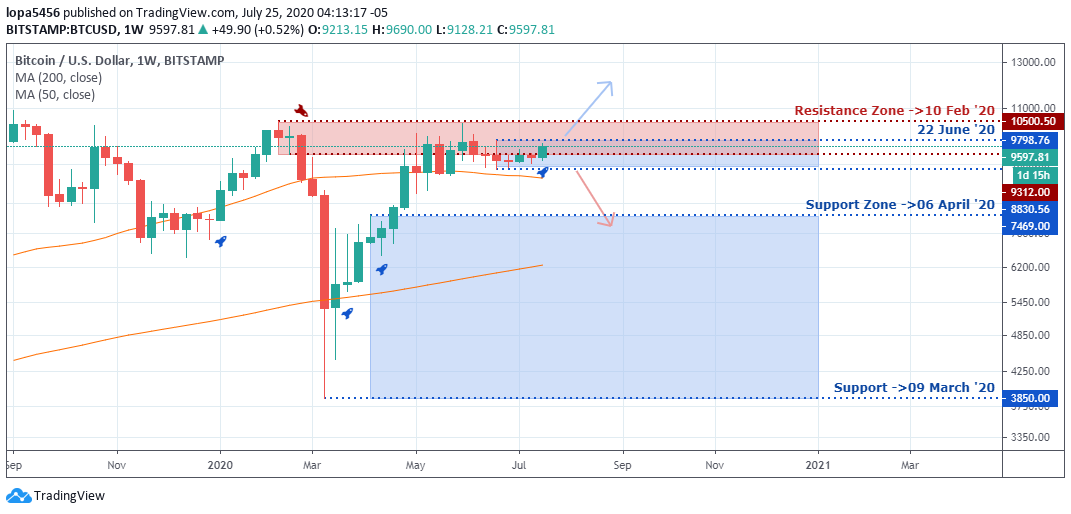

Weekly Chart

Weekly Resistance Levels: 10500.50, 9798.76, 9312.00

Weekly Support Levels: 9798.76, 8830.54, 7469.00, 3850.00,

Bears were able to take the bitcoin price from the resistance level of 10500.50 on 10 February 2020 down to the support level of 3850.00, considering the weekly time frame.

Looking at the reaction of the price at the level shows that the support level of 09 March 2020 shows that at the demand zone, bitcoin brokers had long contract positions opened at the zone that led to an uptrend in the market for weeks.

Singapore brokers lookout for a break above the zones 9798.76 and 9597.81 within the larger area of 10500.50 and 9597.81. This should establish a definite price direction of BTCUSD in the weeks to come.

Daily Chart

Daily Resistance Levels: 10428.00, 10018.67, 9792.00

Daily Support Levels: 9182.66, 8970.00, 8533.98, 8106.70, 7390.00

At publication time, the daily chart shows a bullish candlestick broke out of the descending triangle to the upside after absorbing the bear’s pressure around the support zones of May 4th and 11th, 2020.

A retest of the 9182.66 and 8970.00 levels with a bounce will signify a takeover of the buyers in the market as the days go by.

If the Bulls can turn the 10th and 22nd June 2020 resistance levels into support, it will expose the 10428.00 resistance level in the coming days.

Singapore brokers should be more cautious of the breakout because it may be a failed breakout to trap traders before getting a reversal to the other side of the market.

H4 Chart

H4 Resistance Levels: 9798.76, 9479.57

H4 Support Levels: 9125.21, 9025.75, 8900.00, 8830.63

The BTCUSD price has entered into the resistance zone that rejected the buyer’s advancement as of 22 June 2020, around 9798.76 prices. If the Bears can hold the zone, we expect to see them take over the market from the Bulls to push back the price to the 9479.57 level.

The Bulls surge from the support levels of 5th and 16th July 2020, 9025.75, and 9125.21 respectively gives us high and higher highs and higher lows that broke above the resistance level of 9479.57.

In the coming days, we shall know if the bullish rally can close above the 9748.76 resistance zone of 22 June 2020, or we get a push back to the recent resistance level turned support of 9449.57.

Bullish Scenario:

A general bullish scenario is at play on the H4 time frame and daily chart.

We expect the Bullish rally to take the price of bitcoin up to the 10428.00 level in the coming days if the Bulls can overcome the resistance zones built during June before seeing more buyers in the market.

Bearish Scenario:

2019 high serves as a significant reversal level bulls should pay attention to, and consider taking out some profit going forward.

Bitcoin BTC News Events

China Recognizes Blockchain jobs as new Occupation Officially.

The Chinese governments set up engineers for blockchain amid the COVID-19 pandemic since it harmed the global market.

The human resources and social security of China were able to infuse professions like engineers, technology developers, and analysts, among other recognized jobs.

The Chinese banks also want to accelerate the blockchain adoption strategy because the government has tested two blockchain-related projects amid the COVID-19. Also, the government has carried out a national blockchain network called the “Blockchain-based Service Network.”

Conclusion and Projection

Singapore brokers need certainty and stability in the market amid the COVID-19 second wave pandemic. With risk on investors would not want to lose their investments and other portfolios.

The question that bitcoin traders have on their mind is on the break out of the trend line on the daily timeframe. Will it lead to bitcoin value in the coming days, or is it a false breakout?

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd • covid-19