ECB meeting and UK Election take center stage

Fundamental

The EURGBP pair has staged a striking rally in the month of May and has been range-trading so far in June, note Binary Options Brokers. The consolidation doesn’t come as a surprise ahead of the decisive ECB meeting and UK election on June 8.

Popularly dubbed Super Thursday by traders, it’s a key day for the EURGBP exchange rate. Going into the day it is expected for the ECB to turn slightly less dovish in its monetary stance and for Theresa May and her Conservative party to win the election.

The day is certain to be very volatile so traders are advised to scale back on positions or avoid trading. The alternative route can be though, to trade the pair with a regulated binary options broker by taking positions in binary options.

Although there are near-term risks to the downside, analysis at UK Binary Options Brokers suggests that in the mid-turn the uptrend in EURGBP has further room to run. The main postulates of this forecast are the ECB turning more hawkish and a difficult start of Brexit negotiations which should put downward pressure on the British currency.

Technical

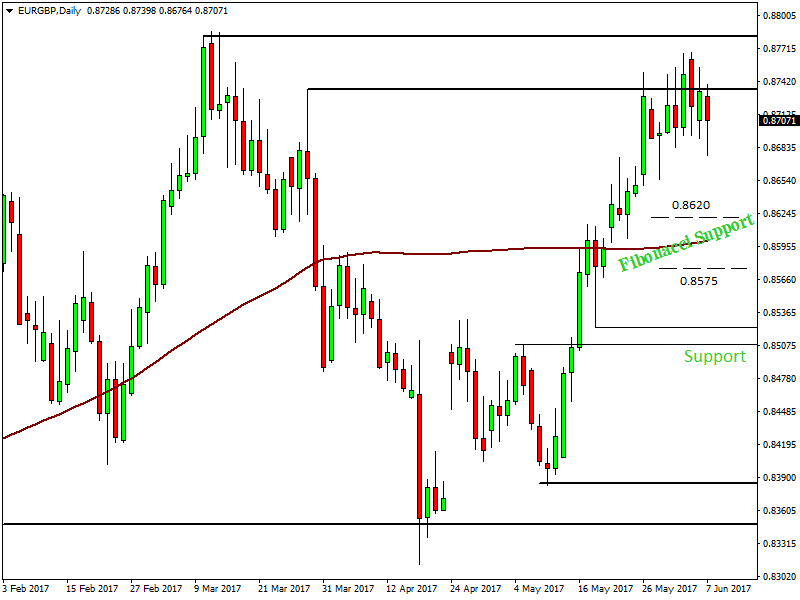

The technical picture also suggests that there is at least a near-term top in place. With this in mind, the highs in the 0.8760 – 0.8785 area are firmly resistance.

To the downside, there is Fibonacci support at 0.8620 and 0.8575 respectively, or this whole area of 0.8620 – 0.8575 can be treated as one area of support, UK Binary Options Brokers advise. In addition to the Fibonacci confluence support, the 200 – day moving average stands in the middle of this area – right at the 0.86 handle.

0.85 and 0.8350 are the next major support levels lower on the daily timeframe.

If the bullish scenario does play out and the EURGBP moves above the 0.8785 resistance then the road to 0.90 will be freely open.

RISK WARNING

Your capital may be at risk. This material is not investment advice

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021