The US Dollar depreciated sharply on Friday after the awful Non-Farm payroll number and EURUSD is now more than 200 pips higher than Friday’s open.

Note, that more volatility is likely this month, mainly related to the upcoming referendum in the UK which result is too close to call.

The technical picture for EURUSD is bullish after Friday and the strategy now is to look for buying opportunities.

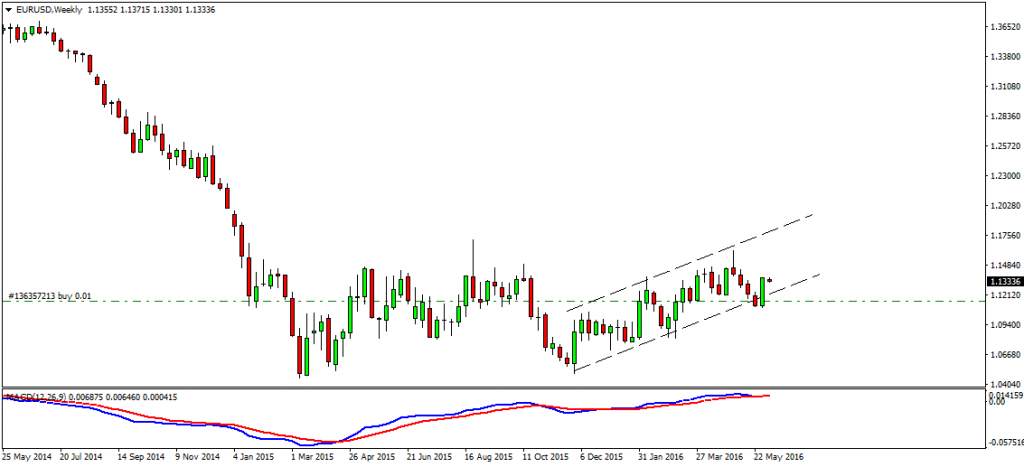

Weekly chart

Contents

The price has returned inside of the channel which it hardly ever broke. The reversal comes after a strong bull candle in the form of a bullish engulfing pattern.

So, now the target for long trades is again to the highs at 1.17 – 18.

Daily timeframe

On the daily chart, the harmonic bearish butterfly pattern returns in play, which we looked at last month. As you can see the target of the butterfly coincides with the resistance trendline of the channel and the strong multi-year resistance area at 1.17 – 18. With the current strong bullish momentum after Friday, there are higher probabilities that the pair will indeed reach this area.

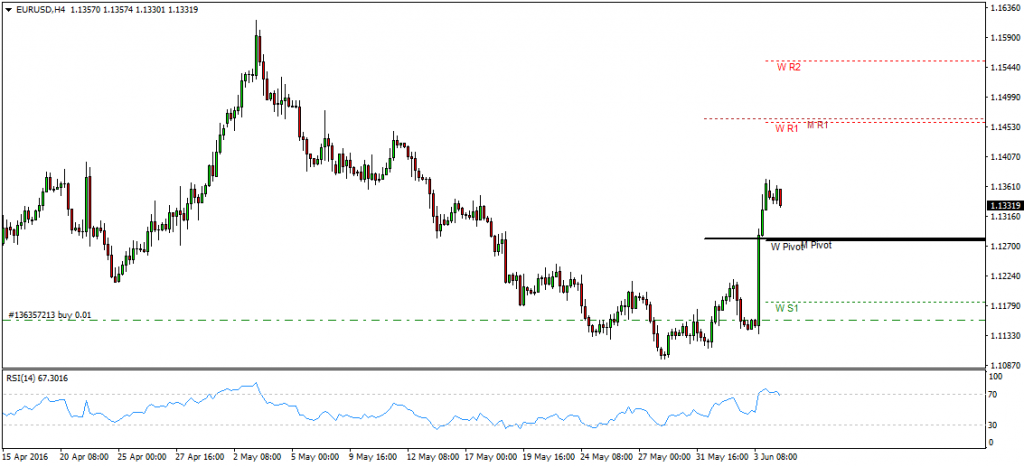

4h timeframe

We can see that at the moment the market is digesting the sharp move from Friday and this gives us a chance to buy the pair.

There is no way to know if it will retrace back a little bit more or just go straight up from here. We can see that momentum oscillators like the RSI show overbought levels, which usually means the consolidation will last for a day or two.

The monthly and weekly pivot points are at the same level (1.1282), so this will be a good buying area, again if the market gets to it.

Another strategy would be to enter long with a smaller position at the current price so that you don’t miss a move higher.

A fall below 1.1250 (which is 50% of Fridays move) would seriously put in doubt the current bullish picture for the pair.

Our Recommended Brokers:

Best Broker for US Traders

- They accept US clients

- 1-Hour Withdrawal

- Paypal & AMEX Accepted

- $1 Minimum Trade

- Huge Bonuses

- Highest Returns

- Weekend Trading

- Free Education

Best Global Broker

- Up to 100% Deposit Bonus

- Over 200 assets to trade

- Up to 90% Payout

- Quick withdrawals

- Fully Regulated Broker by CYSEC

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021