EURUSD Forecast

Contents

Introduction

US data release shows that the economic health of the country is improving after the figure was higher than the forecast. Binary options brokers will observe key levels in the market as they expect a breakout or a bounce from the zones.

US Infrastructure bill has finally seen the light after the US senators approved it. The bill will boost the recovery process and create employment and attract investors to the economy.

EURO and US News

US CPI (Consumer Price Index) M/M

The Consumer Price Index accounts for the overall inflation level in the economy. The central bank raises its interest rate as a containment procedure when prices are on the rise. Surveys were carried out on prices of various goods and services and compared to the previous samplings.

If the various samples carried out should show that the actual is greater than the forecast, it is good for the currency, but if the outcome is lower than the forecast, it is not suitable for the US dollar.

The Forecast is 0.5% while the Previous data was 0.9%.

The French Final CPI m/m

The France CPI has two versions, which are the Previous or Preliminary and Final. The preliminary is released earlier and they are 15 days apart. The previous version has a higher impact than the final version when they are released.

CPI reveals the changes in the price of services and goods from the producers that consumers pay. An outcome higher than the forecast is good for the US currency, but a result lower than the forecast is not suitable for the currency.

The previous data was 0.1% while the forecast is 0.1%, the positive outcome will be a sign of a healthy economy.

EURUSD Technical Analysis

Monthly Overview: Bullish Consolidation

Monthly [MN] Resistance 1.2554, 1.23252, 1.21544

Monthly [MN] Support 1.17059, 1.17041

Some weeks back, we saw how the bulls were able to push the price of the pair up from the low of 01 July 2021 Candlestick in anticipation of a bullish run. However, the bullish run was short-lived, having seen the bear’s momentum returns after the US data shows a healthy economy and recovery.

A strong bearish run from the 1.18599 zones pushed the price down to the low of the previous month 1.17510. A close below the zone and lower than the 1.17011 will take the price of the EURUSD lower and lower.

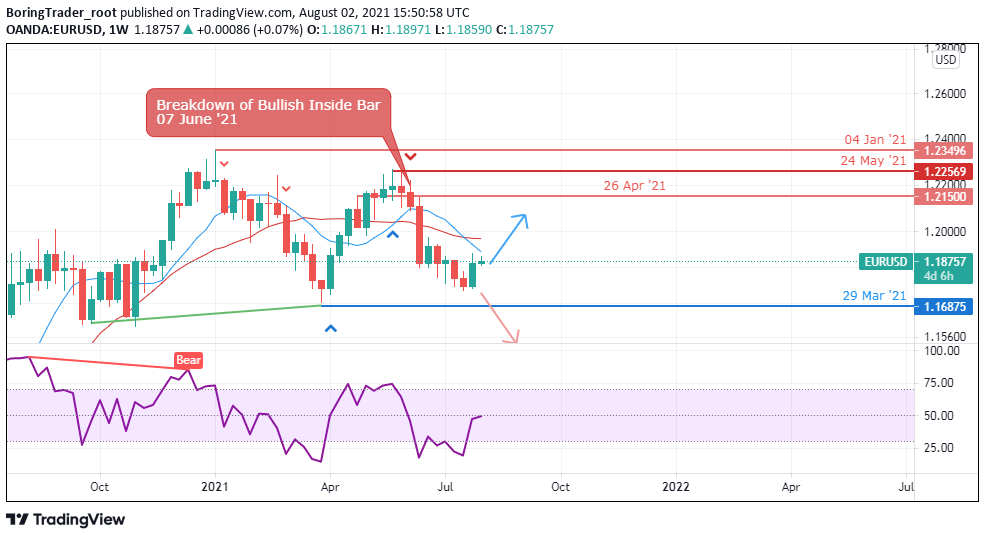

Weekly Chart Down Trend

Weekly Resistance levels 1.19087, 1.19753, 1.22664

Weekly Support levels 1.16875

The Online broker’s resistance against the long position traders paid off after the bull’s attempt failed to close above the resistance zone of 1.19125. Short position traders overpowered the bulls and they push the price down to the 1.17563 zones. The Bears will need to close below the current zone of the price if they need to go lower and dominate the market.

The short position traders dominate the EURUSD pair as the fundamentals are favorable to the US economy. The bears pushed the pair down from the resistance level after overturning the bullish run. A close below the 1.17563 support will expose the lower support.

Daily Chart Projections: Downtrend

Daily Resistance Levels 1.19087, 1.22187

Daily Support levels 1.17059

1.19125 rejection, a recent breakdown below of 1.18469.

The resistance level of 1.19125 has held for some days with no successful breakout by the long position traders. However, the sellers were in control and broke below the 1.18469 zones with a strong bearish candle taking the price of the EURUSD pair to the low of 1.17011.

A close below the current support will push the price lower but if they bear momentum is weak, we may see the Bulls surge again.

Conclusion & Price Objectives

The Infrastructural Bill of $1 Trillion is an enormous boost for the US economy as the government is not going to allow the recent increase of the COVID-19 infection to slow the recovery progress of the country. Some are of the opinion that the bill will cause the inflation rate to rise because of excess liquidity in circulation.

The EURUSD is most likely to favor a bearish trend for the week as we expect more feeds from the US economic calendar to favor them.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD