EURUSD Forecast

Contents

Introduction

The US economy is not having the best of luck with all the pandemic effects on the U.S dollar. In times of crisis, organizations need leaders who can guide people, institutions, online brokers such as IQ Option and investors through the market volatility, leaders like Janet Yellen, Mary Barra and Christine Lagarde.

EURO and US News

In celebrating these three notable women Janet Yellen, Mary Barra, and Christine Lagarde, we have seen them navigate critical Institutions through tough times by setting goals, inspire people and move organizations through disruption. In the areas of economics, business and finance, they are innovators in the world of money.

European-based International Monetary Fund advised its government to help companies or face the gush of bankruptcies and unemployment threat that eliminate over 10 million jobs. Government must bring the COVID-19 pandemic under control also market jitters, online brokers over the possibility of inflation.

Unemployment Claims

We consider the general view on the initial claims to be lagging data compared to the time when the reading is at the extremes. For those policymakers involved in the monetary policy of the country, they pay close attention to the unemployment rate because there is a correlation between it and that of the Labor market conditions.

The policymakers also pay attention to the numbers of individuals who are filing for jobless claims insurance for the first time in the new week. Data higher than expected is not good for the currency while a lower outcome is good for the U.S dollar. The Forecast is 457K while the previous result was 473K.

EURUSD Technical Analysis

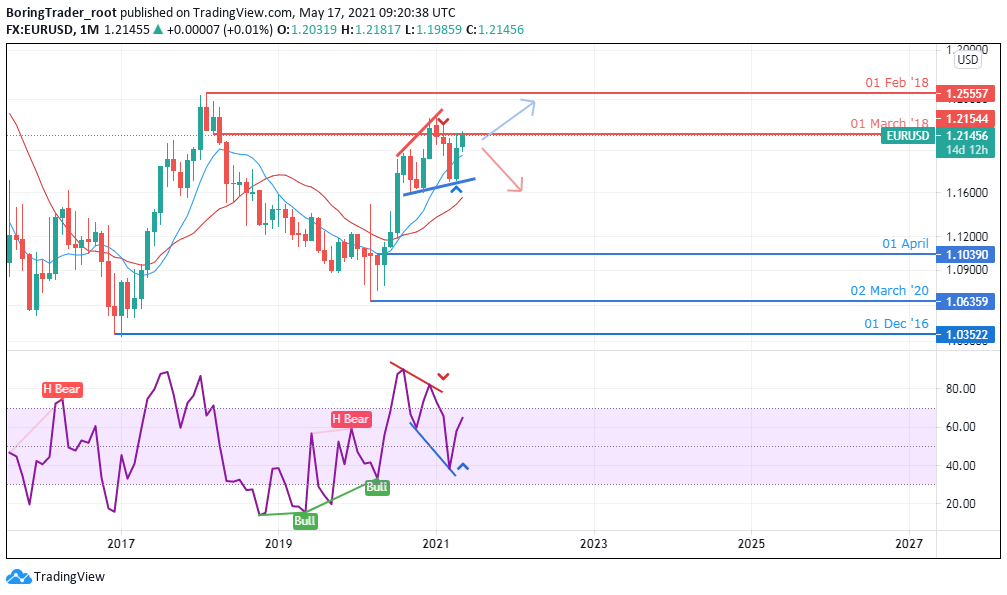

Monthly Chart Objective: Uptrend Resumes

Resistance Levels 1.25559, 1.21554

Support Levels 1.10391, 1.0359, 1.16000

An uptrend resumes on the EURUSD pair as the bulls rejected the initial push of the Bears from the 1.16600 level. The dollar is weak in the financial market because of the COVID-19 pandemic which affected the most acceptable currency in the world.

The EURUSD pair is bullish as at the close of March and the bullish run is still active in May. We expect the pair to test the high of 1.25559 before the pair becomes weak. A close above the zone will open the pair for a new high for the year 2021, but if it fails, we shall see the U.S dollar getting stronger from the zone for a bearish trend.

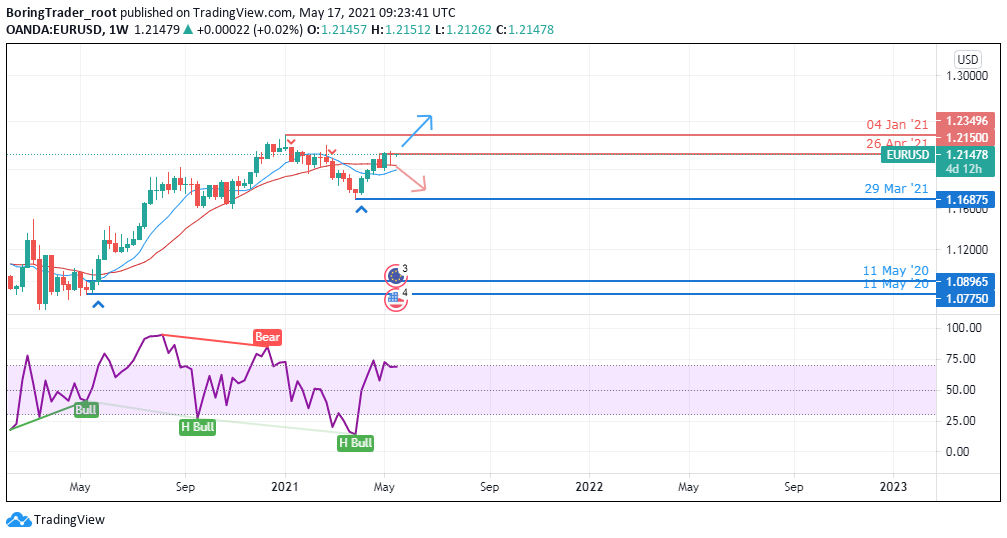

Weekly Chart Uptrend

Weekly Resistance Level: 1.23497, 1.21500

Weekly Support Level: 1.16875, 1.07750, 1.08963

Market participants, online brokers are growing in confidence that the Federal Reserve will hold off on the interest rate despite the worrisome near term inflation spikes has the US Treasury yields is stalled.

The week is bullish for the EURUSD pair as the bulls push higher for a close above the resistance zone if the Federal Reserve meeting favors them for a continuation of the trend.

However, the tone of the chairperson will determine the phase of U.S dollar in the coming days as we pay close attention to the reading of the minutes of the meeting. A rejection of the bulls from the resistance zone will bring the pair down.

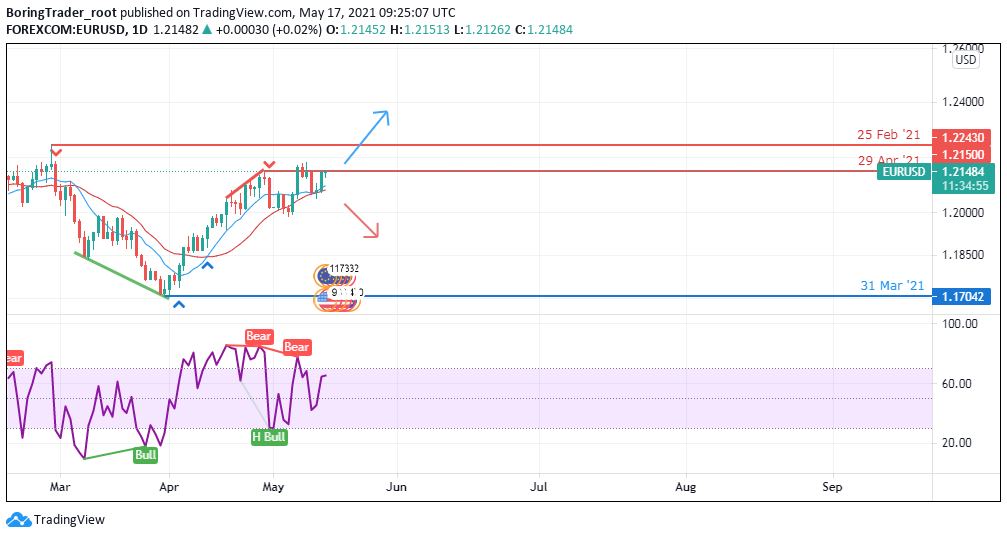

Daily Chart Projections: Uptrend

Daily Resistance Level: 1.22430, 1.21501

Daily Support Level: 1.17043, 1.19860, 1.20515

The indicator points for an uptrend as it crosses over level 50 on the stochastic indicator attracting more buyers into the market for a breakout scenario as the trading week opens. The lows are getting higher and a close above the recent high will attract more buyers into the market.

The market is bullish biased as the trend favours the Bulls despite the FED meeting approaches. However, nothing is certain in the financial market as we expect traders and online brokers to wait until the outcome of the meeting is certain and the market direction cleared.

Conclusion and Weekly Price Objectives

The fear of the Fed rate hike is fading as many analysts believe the committee will keep the rate as it is. The risk appetite lures investors away from the safe-haven greenback as it continues to extend its slide in value.

The week is on a bullish bias as the trading week begins and the outcome of the meeting will clarify the next move for the US currency.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD