EURUSD Forecast

Contents

Introduction

News from the Fed will probably bring high volatility to the currency market. Therefore, online brokers, OlympTrade investors, and other retail traders will probably stay away from the platform. The interest rate decision will also interest brokers and other investors because of the risk exposure of their business.

EURO and US News

Flash Manufacturing PMI

They carried a survey among 5000 managers to rate the standard level of operation of the business in terms of employment, price, inventories, and production among others. They base the diffusion index on the managers’ reports in the manufacturing industry. A report above the forecast is good for the US currency, but lower data will boost the Euro against the dollar.

Any data that is above 50.0 shows expansion in the industry, while a lower figure means contraction. As the COVID-19 infection cases continue to rise, traders shall continue to observe the economic effects of the recent crises and how the economy is reacting.

US Existing Home Sales

The existing homes account for new residential buildings sold during the previous month. The National Association of Realtors, view this report as an exclusion of new buildings under construction from the numbers of sold residential.

If more homes are sold, it will be good for the economy and it will have ripple effects on the health of the economic activities in the country. They release the report after 20 days in the month. Therefore, if the report is greater than forecast, it is good for the currency but a lower outcome is not suitable for the currency.

The previous data on home resales was 5.99M while the forecast is 5.87M

EURUSD Technical Analysis

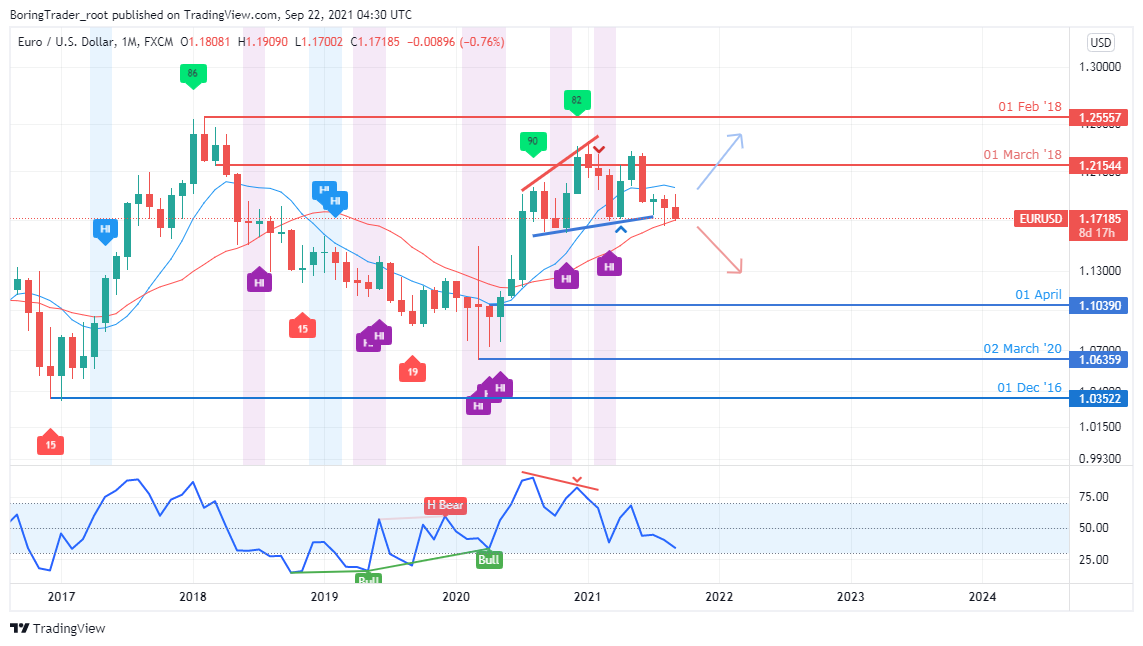

Monthly Chart Objective: Down Trend Buildups

Monthly Resistance levels 1.2300, 1.18500.

Monthly Support levels 1.16000, 1.16500.

Online brokers are seeing a possibility of a breakout below the psychological level of 1.16000 as the selling pressures increases around the zones. The EURUSD pair has moved about 5.20% to the south from the high of 1.22300 after the price retested the highest point of the year 2021 and it looks like the market wants to trade away from those areas as the year draws to a close.

However, if the psychological zone can repel the seller’s attempt, we shall see the buyers take over the market to push the price higher.

Weekly Chart Down Trend

Weekly Resistance levels 1.18000, 1.19000

Weekly Support levels 1.16510, 1.17088

The last two weekly candles have shown that the sellers are in the market and they are countering every move of the buyers. As the trading week begins, we shall observe the seller’s behaviour around the zones for a breakout below move or we get a rejection by the buyers.

The outcome of the Feds meeting will also give the EURUSD pair a direction in the coming weeks. Online brokers will probably stay out of the market pending the outcome of the meeting.

The U.S economy has been growing stronger recently after the booster has recorded about 75% of protection against symptomatic COVID-19. If the weekly candle should close lower than the 1.16510 levels, we shall see the price drops lower and the US economy gets stronger.

Daily Chart Projections: Downtrend

Daily Resistance Levels 1.22651, 1.118408, 1.19761, 1.18472.

Daily Support levels 1.18480, 1.17011, 1.16972, 1.17723, 1.17564

The US currency is showing signs of strength as the stick and bearish flag formation still favors the bearish trend on the market structure in the daily timeframe. The previous trading week closed, favouring the sellers. As the new week unfolds, we may see the market continue the previous week’s direction as the 1.16670 support is under pressure.

A close below the zone will shift the market sentiments of the online brokers and investors.

Conclusion and Weekly Price Objectives

A report from J&J says that the second jab of the COVID-19 vaccine booster increases protection against illness while federal regulators are evaluating the data.

Report from the clinical trial shows that two months ago since some countries received the second dose of the booster, including the USA, they have seen 75% protection against symptomatic COVID-19.

The US dollar is a safe haven for investors and online brokers as the news on Evergrande troubles the water. If the bearish swing is to continue the price will take out the 1.16500 zones on the daily time frame.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD