EURUSD Forecast

Contents

Introduction

Recently, investors, binary options brokers, and retail traders are concerned with the rise of the Delta variant in the world that has forced some countries to introduce another lockdown. Some countries have recorded high numbers of infected cases recently.

Also, the plan of the Federal Reserves to cut down on the stimulus program will bring about a change in the financial market.

EURO and US News

French Final Manufacturing PMI

The French final manufacturing index was carried out among 400 purchasing managers who rated the businesses within the zone in terms of employment, production, prices, and new orders, among other factors.

When data is above 50.0 it is an expansion in the industry but a figure lower than that shows contraction in the industry. However, if the outcome exceeds the forecast, it is suitable for the currency but a lower outcome hints bearish sentiment towards the EURO.

The forecaster is 57.4 while previous data was 57.3

US Average Hourly Earnings m/m

The Bureau of Labor Statistics will release the data on the US average hourly earnings as we see how changes in businesses influence the payment for labor, which excludes the farming industry. Usually, the report comes on the first Friday of the new month and it is a leading indicator to access inflation on consumers because they pay higher when businesses pay higher costs for labor, which is usually pushed down on consumers.

Therefore, if the data is greater than forecast, it is good for the currency but a lower report is not suitable for the currency. Forecasts are 0.3% while Previous was data 0.4%

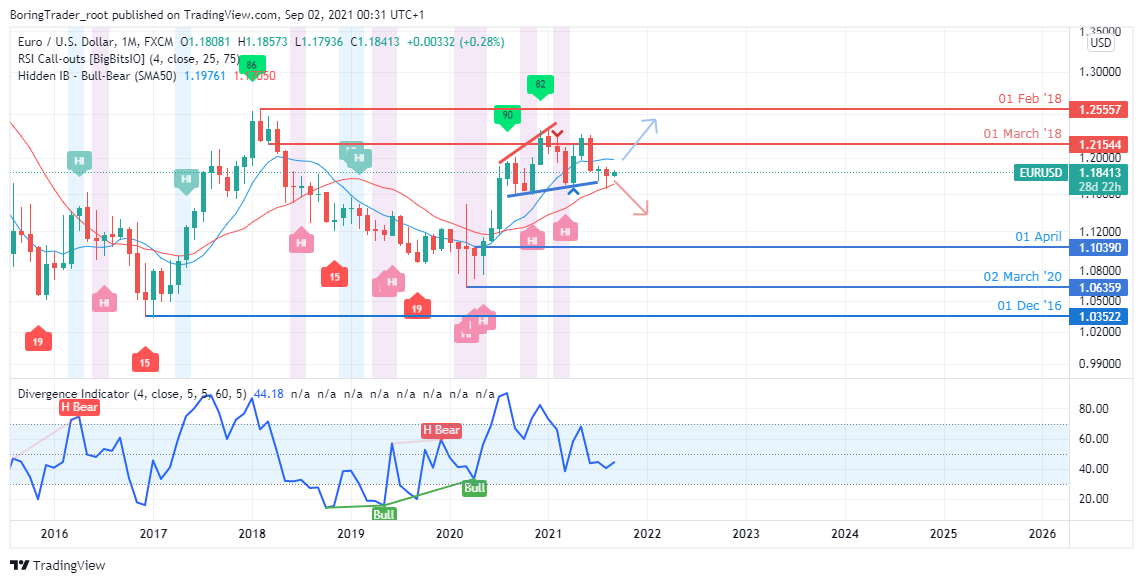

EURUSD Technical Analysis

EURUSD MN Chart Objective: Within Correction zone (MA10 & MA20)

MN Resistance zones 1.19246, 1.22526

MN Support zones 1.16670, 1.16045

The online brokers will watch the psychological zone of 1.16045 to see if the bears’ pressure can breakout below the zones. The zone has been tested recently by the Bears. If their momentum can push lower, we shall see the price targeting another support level in the future.

The Bullish momentum may be seen from the 1.16670 and 1.16045 zones if they can reject the pressure from the short position traders. Psychologically, the zones attract bullish bias for those long position traders with the aim of taking the price to the resistance zone of 1.19246.

Weekly Chart Down Trend

Weekly Resistance levels 1.18000, 1.22154, 1.19049

Weekly Support levels 1.16989, 1.16681, 1.16897

The weekly chart shows the buyers pushing back the price from the opening of the previous week’s candle (1.16989) and closing it at the entry point of the upper week’s candle that the short position traders dominated around the 1.18000 zones. The last weekly candle shows a railroad track formation that may likely take the price higher if we are to see the bulls close above the 1.18200 zones.

The bullish momentum may be sustained if the support zone of 1.16897 can act as the second leg for a double bottom of the weekly timeframe.

However, the market structure is bearish, but the next swing will have to close lower than the recent support level of the EURUSD pair for the downtrend to continue in the market.

D1Projections: Downtrend Slowing

D1 Resistance zones 1.19083, 1.18052

D1 Support zones 1.17200, 1.17011, 1.16619

The market structure of the EURUSD pair was previously bearish before the new week resumes, bringing the month to a close during the week. The bears will need to create a lower low below the significant support (1.16619) for the downtrend to continue. If they cannot shift the price lower, we shall see a reversal of price from the zone.

We can see that long-position traders were able to push the price towards the resistance zones of 1.18052 as the market closed from the previous week. If the buyers must continue the bullish bias, they have to close above the current resistance level and push the price of EURUSD to the high of 1.19083 while the support swing must not close lower than the 1.17200 level.

Conclusion and Weekly Price Objectives

The US Federal Reserves hints they will soon start the reduction of the stimulus program as they see certain levels of progress in the economic activities of the country. The COVID-19 vaccine is being promoted in various parts of the world to reduce the death rate and transmission of the virus, while they introduce lockdowns in some countries.

A Bullish railroad track of the EURUSD pair may likely dominate the market from the support zone of 1.16681 on the weekly chart which may take the price higher. Online brokers and other investors are monitoring the zones for either a breakout below will occur or the zone will lead to a bounce for a rise in the pair.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD