EUR to USD Forecast

Contents

Introduction

The race to deliver the COVID-19 vaccines continues as it’s clear that the economies that come out of the pandemic should have a head start.

The Euro, with an extended lockdown, trails the USD and the GBP. It faces a beatdown by both top economies as revealed on online broker sites.

Read on for more on the technical and recent events driving the EURUSD foreign exchange.

EURO and US News

The MSCI world shares index saw a 0.5% rise for two days now following an increase in positive sentiments on the US economic stimulus and a likely global recovery from the covid-19 pandemic.

The Index (MSCI), which tracks shares traded in 49 countries, strengthened in three months Monday.

Retail investors that recently made a buzz by buying up Gamestop stocks and causing the short squeeze on Wall Street bears shifted their attention to the silver futures market and other silver stocks and mining companies.

Stoxx 600, the European stock index increased by 0.9% even as the Euro slumped against the USD.

Global markets generally experienced buoyancy in anticipation of negotiations on the COVID-19 support bill by President Joe Biden and the Republican party senators.

This week Tuesday, the Euro dropped to its seven-week lows trading against the USD following concerns over extended lockdown in Europe and a positive outlook on the USD from the US stimulus.

In Q4 2020, a less than expected contraction in the Eurozone economy was noticed, as revealed by the European Union Estimates.

Data released on Monday showed a plunge in Europe’s retail sales over the December forecast.

Commerzbank strategists stated how depressing the situation is now. A disappointing German retail sales report highlights the rate at which the service sector is hammered under the current lockdowns in Europe.

The Greenback also profited from massive short-covering from bears against the JPY, which hedge funds are believed to have stacked up the most significant short wagers against the USD.

Many analysts consider the current rebound of the Greenback to be a mere correction from the Q4 2020 decline, losing about 7% in 2020.

Millennium Global’s head of strategy, Claire Dissaux, maintains caution towards the USD making reference to European assets’ interest over US markets.

She sighted a rather negative short term outlook for the Euro compared to the US dollar. However, a more constructive long-term view for the Euro.

The Greenback also gains support on hints that President Joe Biden may further advance with his 1.9 trillion USD COVID-19 relief plan even if he doesn’t gain the help of the Republicans.

EURUSD Technical Analysis

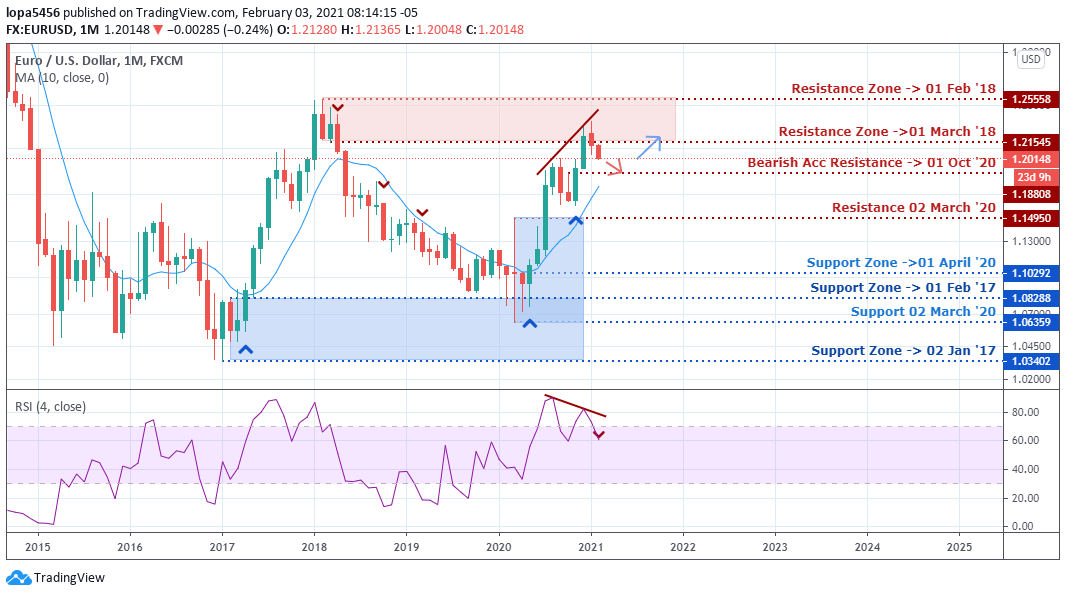

Monthly Chart Objective: Bullish and slowing

Though the EURUSD bulls appear to find resistance as they peaked above the March ’18 resistance 1.21544, they continue to show resilience as the pair has not yet closed below the 1.20114 marks.

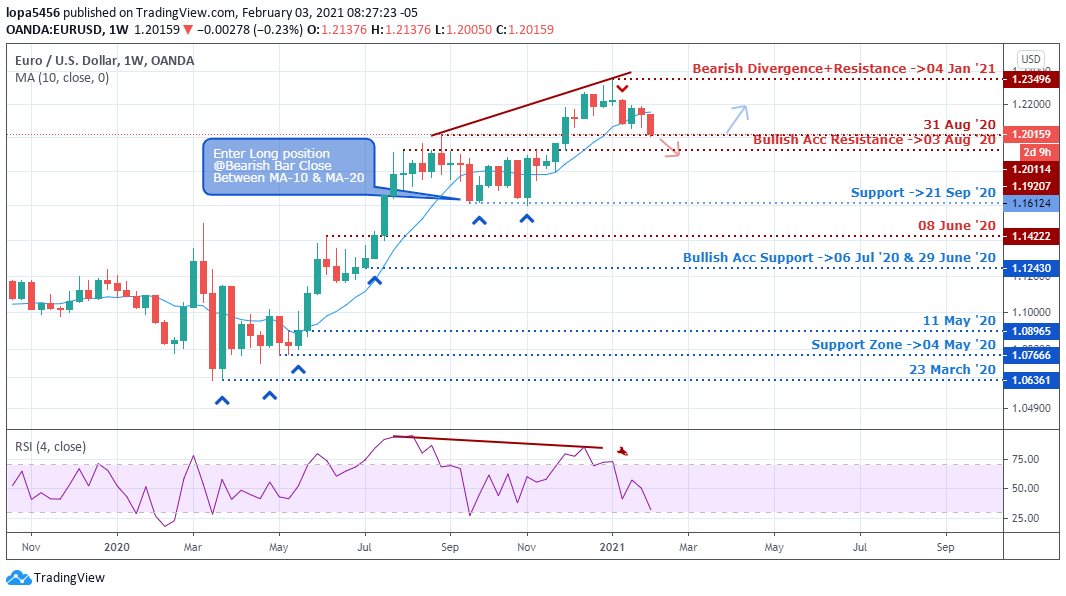

Weekly Chart Bullish

The bears show their presence by again signaling a second bearish accumulation, this time on the weekly chart.

We may see an extended decline in the EURUSD exchange rate all through Q1 ’21.

Daily Chart Projections: Bullish

After a bull trap on 06 January ’21 that left the bulls holding the bag, the EURUSD exchange rate tumbled lower to signal an end to the uptrend on the daily chart.

An increase in confidence for the US dollar continued as the bears continued to crack through significant support levels.

EURUSD Conclusion and Weekly Price Objectives

The US dollar attained a two-month high against the Yen and Euro, following a positive outlook on the US economy from released data.

An improvement in US employment was a major macroeconomic event that gave confidence to the Greenback.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD