United States – The Conference Board (CB) Consumer Confidence Index

Tomorrow, at GMT 2:00 p.m., United States based Conference Board Inc. (CB) will release its consumer confidence index, which measures the changes in the level of a composite index by surveying 5,000 households in the United States.

The large sample size (5,000) of the survey makes it one of the most comprehensive research data regarding the consumer spending pattern in the country. Since consumer confidence is correlated with consumer spending, binary options investors pay close attention to the CB consumer confidence index.

Last month, the CB consumer confidence index reading came out at 92.2 and the forecast for February is currently set at 93.9.

Australia – Private Sector Credit

On Thursday, at GMT 12:30 a.m., the Reserve Bank of Australia will release the month-over-month Private Sector Credit data, which measures the changes in the total value of new credit issued to consumers and corporations in the country over the previous month.

Binary options traders consider the private sector credit to be an important fundamental indicator of the Australian economy as borrowing and spending are highly correlated. Consumers and businesses only take out credit when they feel confident about their ability to pay it back in the future. Hence, it also acts as a measure of consumer and business confidence.

In February, the private sector credit in Australia increased by 0.5% and the forecast for March is currently set 0.5% as well.

Trade Recommendation for the AUD/USD

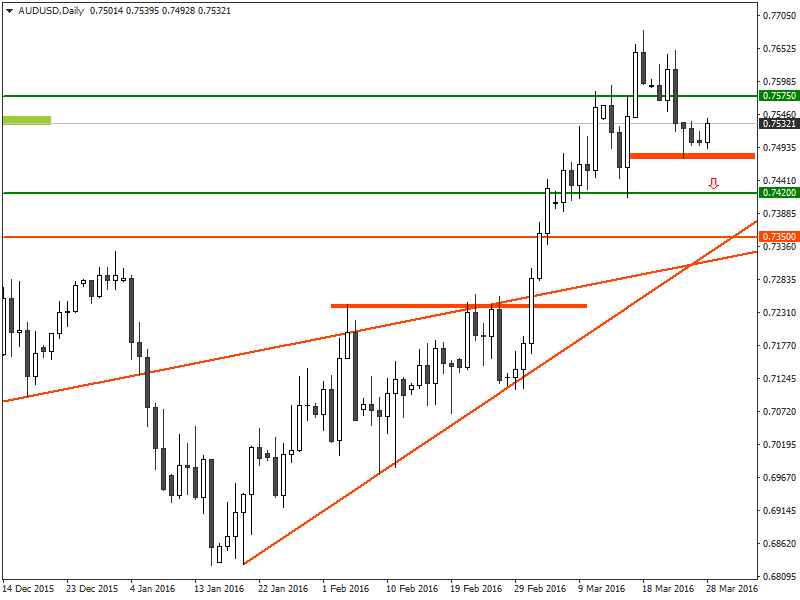

Since January 15, the AUD/USD has remained in a strong uptrend and formed several uptrend lines in the process. After the AUD/USD price closed above the important pivot zone around the 0.7250 level, the uptrend was accelerated, which pushed the price as high as 0.7680 on March 18.

But, soon the overdue bearish retracement started and last week the AUD/USD price came below the psychologically important support level around 0.7575.

As the Consumer Confidence Index is expected to go up this week, we believe the fundamental outlook for the AUD/USD would likely remain bearish for the next few days.

Under the circumstances, it would be recommended that binary options traders consider placing a PUT order for the AUD/USD with their binary options brokers once the price closes below the last week’s low, which is at 0.7475.

Tagged with: AUD/USD • Trade of the Week