USDSGD analysis October 23, 2017 for Binary Options in Singapore

Contents

Fundamentals

The US Dollar was able to strengthen after a long time against the Singapore Dollar in the past few weeks, though the rebound is still far from significant Singapore Binary Options suggest.

The latest bounce in USDSGD has more to do with a recovery in the US Dollar on a rise of probabilities for a December rate hike from the US Federal Reserve, than it has to do with weakness of the Singapore Dollar. Monetary policy in Singapore is mainly fixated to a simulative – easy stance as inflation remains low and below target for more than 3 years.

This leaves the pair to be driven largely by monetary policy in the United States note Binary Options in Singapore. With the recent jump in inflation above the 2% Fed target, the odds of a more monetary tightening have increased and prospects are good for the rally in the USD to continue for some time, perhaps until December at least – that is if the economy continues to perform well and US inflation stays around 2%, Singapore Binary Options brokers analyze.

Politics will remain in focus for the US Dollar and for the USDSGD pair. Namely, US President Donald Trump is expected to soon announce the successor of Janet Yellen as the chairman of Federal Reserve and this decision is expected to affect the US Dollar. In addition, tax reform plans can also significantly affect the Dollar in a positive way if the revealed plan is of significant scope.

Traders can try to position on USDSGD for a move higher by either going long or buying call binary options with a regulated binary options broker.

Technicals

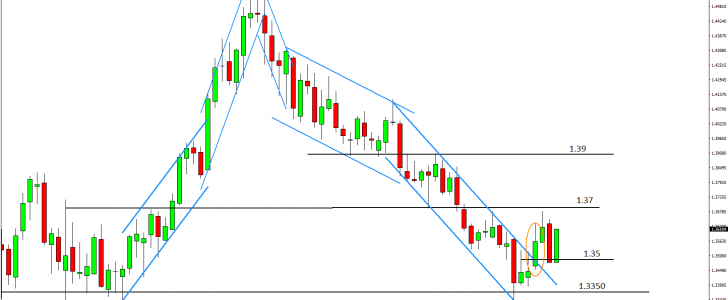

The technicals are pretty much in line with the fundamentals and are currently bullish as long as the pair stays above 1.3450 and particularly above the lows of 1.33. Having broken from a 5-month bearish channel USDSGD is likely to move higher for a while longer point Binary Options in Singapore.

The pair reversed from the 1.37 resistance and is now trading in the range between 1.35 and 1.37.

To the upside, 1.39 is the next resistance area if the USDSGD pair breaks above 1.37.

To the downside, if the pair breaks below 1.35, 1.33 should ultimately hold further declines.

Our Recommended Binary Options in Singapore to trade USDSGD:

Best Regulated Broker

IQ Option is the world’s leading EU regulated financial broker based with a revolutionary platform for all traders. Read IQ Option review

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $10,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 98%*

Top Uk Broker

HighLow is a Top binary options broker in UK with a simple trading platform and free demo account. Read High Low review

- Fast Withdrawals

- Only £50 Minimum Trade

- Regulated Broker by ASIC-Australia

- Bonus £50 Cask-back

- Free Demo

- Up to 200% Return

RISK WARNING

Your capital may be at risk. This material is not investment advice

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021