USDSGD Technical Analysis for Singapore Brokers

Contents

Introduction

The high growth rates and high-interest rates in Singapore has attracted traders to speculate on the Singapore dollar on OlympTrade platform.

Let’s go-ahead analyze the different chart patterns that make for good entry signals to either long or short the USDSGD.

Singapore Retail Sales

Consumer spending which accounts for a majority of the overall economic activity is shown by the Retail Sales Index. Retail Sales are evaluated by measuring variations in the sum value of inflation-adjusted retail sales.

If figures are higher than anticipated, we consider it a negative trend for the Singapore Dollar, whereas we consider any reading lower or less than expected as a positive sentiment for the SGD.

Data made available for November 12 shows that the previous data to read -1.3% while the actual data read 1.9%. The forecast figures read -1.4% hinting at a bearish expectation for the SGD.

U.S. API Weekly Crude Oil Stock

The American Petroleum Institute is charged with reporting the inventory levels of crude oil, gasoline and distillates stocks belonging to the United States. The indicator which gives an overview of the demand for petroleum in the U.s reveals how much oil and oil product is in storage in the U.S.

A more than anticipated rise in crude inventories implies lower demand for crude products—this points to a bearish sentiment for crude prices. We can also conclude thus when the decline in inventories is more than anticipated.

A less than a projected increase in crude inventories implies a higher demand for crude products—this points to a bullish trend for crude prices. We can also conclude thus when the decline in inventories is more than anticipated.

If figures are higher than anticipated, we consider it a negative trend for the USD, whereas we consider any reading lower or less than expected as a positive sentiment for the USD.

Data made available for November 5 shows the previous data to read -0.708M while the actual data read 4.260M, hinting at a bullish expectation for the USD.

USDSGD Technical Analysis

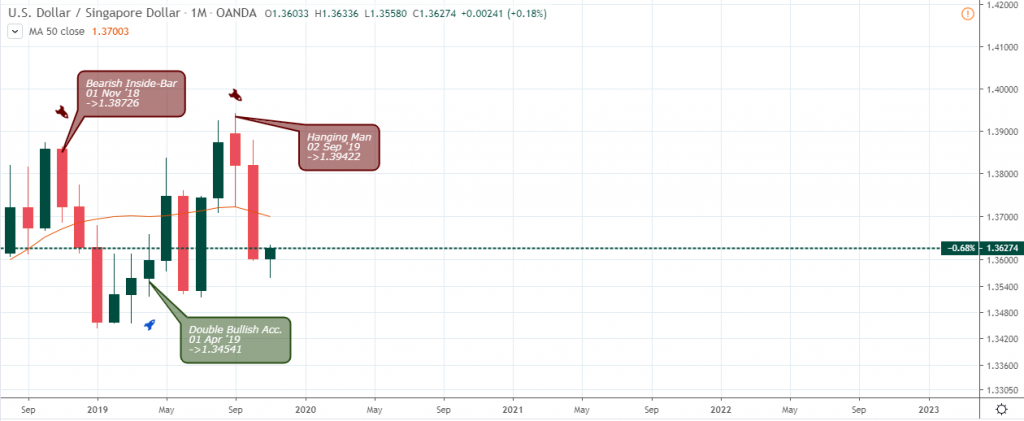

USDSGD: Monthly Chart

The Singdollar showed a strong comeback against the Greenback after a hanging-man candlestick pattern signaled on September 02, precisely 2.76% from the peak to trough.

After the October closing price, it looks like the correction phase is coming to an end. Let’s move on to the lower time frames for confirmation.

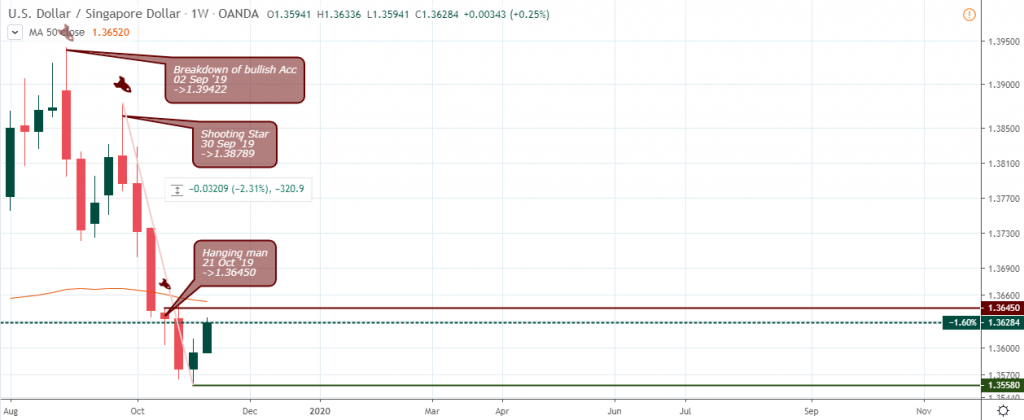

USDSGD: Weekly Chart

From the weekly chart perspective, the bearish trend was ignited by a collapse of the bullish support on September 02. It went on to signal a shooting star candlestick pattern on September 30. The USDSGD drop by 2.31% from the September 30 high to the November 04 low, while it trades below the 50-weeks Moving Average.

The price heads towards the MA-50 and 1.36450 resistance at press time, and we’ll likely see some slowing in rate at this level.

USDSGD Medium Term Projections: Bearish

USDSGD Daily Chart

So, we get the first bullish reversal pattern in the form of a regular bullish divergence on November 06 as the USD to SGD foreign exchange slowly moves up towards the 50-day Moving Average level.

USDSGD H4 Chart: Bearish

Similarly, on the 4hour time frame, the Singapore dollar starts to lose some of its two months gains after signaling a regular bullish divergence setup on November 05, 14:00. The break of hidden resistance on November 08 06:00 fueled the move to finally break through the MA-50 as the pair heads towards the 1.36386 opposition.

USDSGD H1 Chart: Bearish

We start to notice a buildup of regular bearish divergence on November 13, 20:00, for a correction of the bullish trend and perhaps restore some of the gains of the Singdollar after the regular bullish divergence in November 07 19:00.

Conclusion

Although the lower time frames show some recovery on the part of the USD, the long term charts still have established levels that may prevent further advance in the strength of the USD. We’ll lookout for opportunities to short the pair around the 1.36450 resistance.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021