USDSGD Outlook – Binary Options

Contents

Introduction

The restrictions that were newly imposed should be of concern to the IQOption broker because the threat of the virus re-surging has unsettled the region and it is a setback for the region.

Singapore Fundamentals

Some of Singapore’s industries had some setbacks because of the high uncertainty of the recent wave of infections, therefore, introducing tight measures.

The uncertainty of the economy will affect consumer sentiment and price in the future. The labor market will be affected as projects will be in a low state. The core inflation for the economy is average 0–1% for the year 2021, while overall inflation is expected to come between 0.5% and 1.5% According to the Singapore authorities, the overall inflation is expected to remain around a stable range and to ease in the second half of the year as the base effects’ fades.

US Fundamentals

Crude Oil Inventories

The crude stocks measure the number of barrels of crude oil the commercial firms have in their inventory during the previous week. It is volatile to the market because its effects are on the (loonie) Canadians sizeable energy sector, though the news is related to the U.S Energy Information Administration (EIA).

The EIA is an indicator for the US economic market because it is a gauge of supply and demand imbalances in the market which also influences price volatility and production level.

If the outcome is lower than the forecast, it is good for the US dollar but a higher outcome is not suitable for the currency. The forecast is -4.0M while the previous data was -6.7M.

USDSGD Technical Analysis

Long term Projection

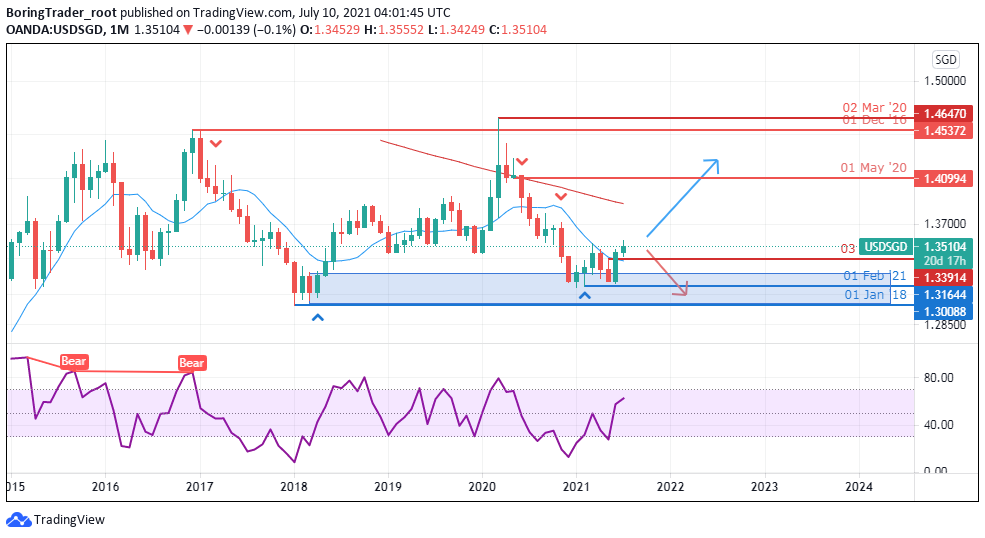

Monthly Outlook: Price Heads for MA-200

Monthly Resistance 1.35255, 1.41405, 1.45372

Monthly Supports 1.33914, 1.31644

The 1.31644 support zones have been a springboard for the USDSGD pair as the previous month closed engulfing the month of May. The price movement closed above the high of 1.33914 and turning it into a support zone which has been pushing the pair up towards the 1.41405 level once the rally can pass through the 1.35255 levels.

The pair may see weakness from the 1.35255 zones if it cannot close above the zone and the price may retrace towards the 1.33914 level to gain support for another bullish rally if the bulls should lose their momentum now.

However, the Bears are hoping to close below the significant support zone of 1.30088 to have total dominance of the market if they can overturn the support level into a resistance.

Weekly

Weekly Resistance Levels: 1.35328, 1.3700, 1.4100, 1.42722

Weekly Support Levels: 1.31578, 1.33764

The recent surge of the COVID-19 in the Asian region has affected the recovering progress of the continent as restrictions will bring lockdown and close of businesses. The Bulls really is because of the Fed’s decision to start its taper program sooner which led to the breaking out above the trend line.

A close above the 1.35328 resistance zone will trigger a long position trader to open their position for a rally towards the 1.42722 resistance levels.

Daily Outlook: Bearish

Daily Resistance Levels: 1.35200, 1.34373, 1.35310

Daily Support Levels: 1.32000, 1.33000, 1.33970, 1.3400

The bias must have shifted for the Singapore brokers from a downtrend to an uptrend on the daily chart. After the Bulls rejected the bear’s advancements with strong bullish candles, we can see the price of USDSGD creating higher highs and higher lows. The trend is bullish, a breakout above the daily resistance trend line of 1.35310 will take the price of the USDSGD pair to another resistance level of 1.3700.

If the Bulls fail to close above the trend line of 1.35310, we may see the bears pushing back the pair to the low of 1.3400 or lower.

Bullish Scenario:

A bullish scenario is expected to continue throughout this trading week if as long as the US fundamentals favor the currency. However, if the weekly candle can close above the 1.35310 zones we shall see a price on a bullish run for some days.

Bearish Scenario:

The recent wave of the Covid-19 crisis in Asia will weaken the Singapore dollar and other emerging currencies against the US dollar. We may not see much of a bearish market now until we see a failed attempt of the bulls to close above the resistance zone of 1.35310.

Conclusion

The USDSGD pair closed the previous month with a bullish momentum showing signs of strength for the U.S dollar, this may be the beginning of an uptrend for the pair after a long bearish trade.

The unexpected rise in COVID-19 cases in the Asia region will affect the international transaction of the region which will weaken the currency.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: usdsgd