USDSGD Outlook – Binary Options

Contents

Introduction

Top online brokers in Singapore hope that the economic activities will resume in full swing as the restrictions are lifted gradually and the vaccines program has seen some degree of speed which will pave way for a quicker reopening of the economy.

The Singapore central bank Chief believes that the 2021 economic growth could exceed the forecast of 4% to 6% by the end of the second half of the year.

Singapore Fundamentals

Data from the Ministry of Trade and Industry (MTI) shows a reversal of growth by 3.1% in the second quarter of the year compared to the first quarter. Economist believes that the setback is just a minor stumble in the second quarter but the Singapore’s economic recovery is still intact compared to last year’s GDP plunged to 13.3% because of the COVID-19 pandemic.

Some analysts believe that the measures taking by the authority to shut down some activities and tighten the safety measures of the public because of the second wave of COVID-19 has led to the dip in the GDP output. We expect the economic activity of Singapore to bounce back as restrictions are being loosened as the rate of infection reduces.

US Fundamentals

The Conference Board Consumers Confidence.

This is survey was carried out among various households who are asked to rate the economic conditions affecting them in terms of labor, businesses, and overall economic situation. Over 3000 respondents were asked to rate the conditions because of the relationship it has with consumers spending.

If there is financial confidence among households, it will reflect on the way consumers are spending. If the expected data is higher than the Forecast, it is good for the US dollar while a lower outcome is not suitable for the currency. The previous was 127.3, and the forecast is 123.9.

USDSGD Long term Price Analysis

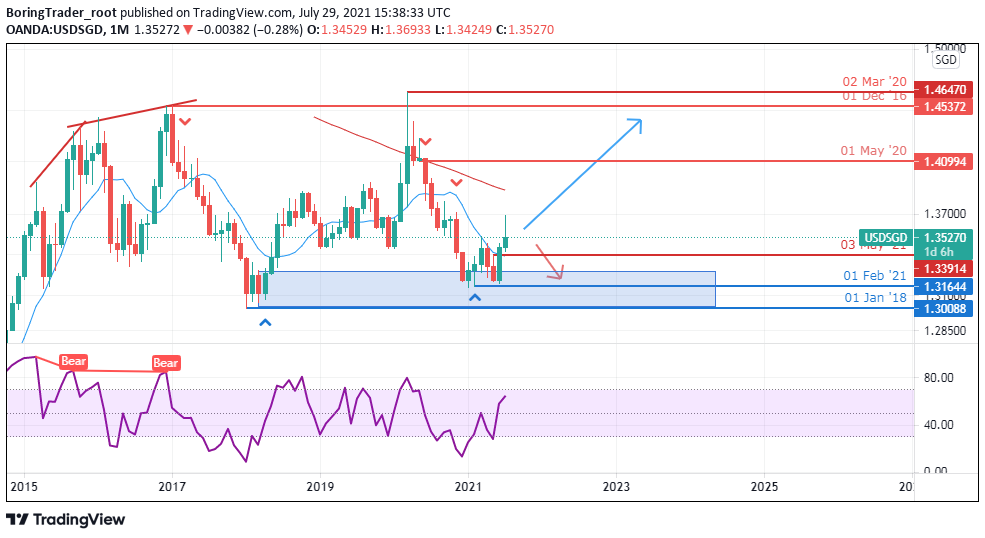

Monthly Outlook: Down Swing Slowing within Significant Support Area

Monthly Resistance 1.37044, 1.44266

Monthly Supports 1.34267, 1.31575

The USDSGD pair has established an uptrend having seen the market formed a double pattern at the low of 1.31575 levels for the bullish run. We saw a breakout above the previous support zone turned resistance (1.34267) with a bullish surge in price hitting the high of 1.37044 before it pulled back. If the bullish momentum is strong, we may see the price closing above the zone for another bullish run to the 1.44266 resistance. However, if the Bulls should fail, we may see sellers dominate the market.

Weekly

Weekly Resistance Levels: 1.35328, 1.37429, 1.38000, 1.44266

Weekly Support Levels: 1.35325, 1.31874, 1.35292

The USDSGD pair is showing a lot of bullish momentum as the Bulls dominate the market with a close above the resistance levels of 1.35328 on the weekly chart and also testing the highs of 1.37429 zone. If the Bulls can overturn the zone, we expect price to rally towards the 1.44566 levels in the coming weeks.

Daily Outlook: Bearish

Daily Resistance Levels: 1.37004, 1.35200

Daily Support Levels: 1.31910, 1.34002

The USDSGD pair has enjoyed some bullish run for some weeks having seen the pair established a strong support level from the 1.31910 which led to an upward trend as it creates higher highs and higher lows. At the writing of this report, we can see a correction phase of the market as the price was rejected from the 1.37004 zones.

We may see price retest the 1.35200 zone before we see another bullish rally, but if it breaks down below the zone, we should expect the 1.34002 to slow the fall in price.

Bullish Scenario:

A bullish scenario is likely to continue if the pair can close above the 1.37004 level having seen bulls enjoyed some rally from the low of 1.31910 on the USDSGD pair. The market is just in a correction state because we have seen no major reversal pattern on the daily chart.

Bearish Scenario:

The bearish scenario is likely a short bias as the overall trend on the chart shows a bullish momentum. However, the bearish trend is yet to be certain as we wait for price at key support zones for either a breakout below or rejection.

USDSGD Conclusion

Last month, the USDSGD closed bullish, hinting at a likely strengthening of the Greenback, and the start of an uptrend. A close above the 1.37004 zones on the daily chart could take the pair into new price discovery zones.

Attention is on the Fed as Singapore brokers search for clues from the meeting as the Fed will have a detailed meeting on the tapering issues and their decision in relation to the uncertainty of the Delta variant (COVID-19). Singapore brokers are concerned about the Feds plan in tight interest rates as the taper program may commence sooner than expected

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: usdsgd