USDSGD Technical Analysis for Singapore Brokers

Contents

Introduction

Following a four month price plunge that lasted till 20 Jan ’20, the USDSGD bottomed on IQ Option platform, sending control back to the bulls on low and medium time frames.

Should we expect a continuation of this price rally in to the longer time horizons? Read on as we uncover the technical chart patterns and fundamental events that drive the exchange rate.

Singapore Bank Lending

The Bank Lending index can determine consumer confidence. The index, which considers borrowing and lending is a measure of the difference in the total value of outstanding bank loans given to consumers and businesses.

A higher than expected reading is thought of as a positive trend for the SGD, whereas a lower than expected data reading is rated negative for the currency.

Most recent data suggest that a positive outlook is imminent for the SGD with the data readings showing that the actual reading is 692.7B while the previous reading is 689.4B.

U.S. CB Consumer Confidence

The consumer confidence index of the Conference Board (CB) evaluates the level of confidence consumers have in economic activity.

A higher than expected reading is thought of as a positive trend for the USD, whereas a lower than expected data reading is rated negative for the currency.

Most recent data suggest that a positive outlook is imminent for the USD with the data readings showing that the actual reading is 126.5, while the previous reading is 126.8, and the forecast figure is 128.2.

USDSGD Technical Analysis

USDSGD Long term Outlook: Bearish

Monthly Chart

While trading below the 200 monthly MA, the USD to SGD signaled bearish divergence setups leading to major price dips as illustrated on the charts above.

The recent bearish divergence sets a resistance level at 1.39422 on 02 Sep ’19 after a dead cross of the stochastic oscillator, and maintains a general bearish outlook.

Although the foreign exchange of the USDSGD trades above the monthly open price, we expect the price to head towards 01 Jan ’18 price objective at 1.30088.

Weekly Chart

The USD to SGD exchange rate bottoms around the 18 Mar ’19 bearish-acc support, at the same time signals a bear trap candlestick pattern while in the oversold zone.

The (-2.63%) increase in sell pressure started after a failure of the 26 Aug ’19 bullish support (1.38616), you can observe how the 18 Mar ’19 support served as support and springboard for a price recoil to the upside.

With that said, we set our first price objective at the bearish engulfing resistance, as the MA-200 should offer good resistance.

USDSGD Medium Term Outlook: Bullish

Daily Chart

From the above daily chart, we notice a regular bullish divergence setup on 31 Dec ‘19 that countered the 02 12 ’19 bearish divergence. This, followed by a double bottom formation on 17 Jan ’20 served as a confluence of events driving the price above the 08 Jan ’20 resistance.

As the USDSGD foreign exchange entered overbought area on 27 Jan ’20, we expect a continuation of the price hike.

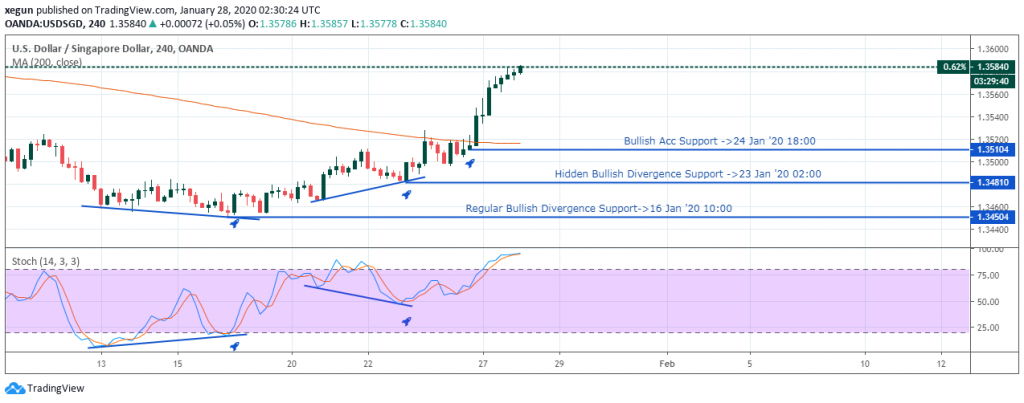

H4 Chart

A view from the 4hour time frame reveals the buying opportunities inherent in the USDSGD FX pair, starting with a regular bullish divergence 16 Jan ’20 10:00 that confirmed the price bottom, and followed by a hidden bullish divergence that confirms a continuation of the bullish trend on 23 Jan ’20 02:00.

Upon a price close above the MA-200, the Singapore dollar lost its grip on the USD as the price soared by 0.65% from the 24 Jan ’20 18:00 support level.

Conclusion

To round up, the Singapore dollar has lost about 1.14% of its last week’s gain following a series of bullish signals across multiple time horizons.

We should look out for setups to scale into the short term bullish trend with measured risk, going forward into the week.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021