United States – Institute for Supply Management (ISM) Manufacturing PMI

Contents

Yesterday, at GMT 3:00 p.m., the Institute for Supply Management released its manufacturing PMI figure for the United States. The ISM’s US manufacturing PMI measures the level of a diffusion index based on a survey of 400 purchasing managers.

Purchasing managers in the United States are involved in the supply side of the economy. As most companies reduce their expenses and production based on their sales forecast, the survey of purchasing managers reveals the overall optimism of various companies in the country. Hence, binary options traders can easily figure out the sentiment regarding the economic condition in the country from the ISM manufacturing PMI readings.

Last month, the ISM manufacturing PMI for the United States came out at 48.2 and the forecast for this month was set at 48.6. However, the actual figure remained unchanged at 48.2.

Australia – Cash Rate

Today at GMT 3:30 a.m., the Reserve Bank of Australia (RBA) released the official cash rate, which is the interest rate that major Australian banks and financial institutions pay to borrow funds held at the RBA.

Since short-term interest rates are the primary factor in the valuation of the Australian Dollar against other major currencies, binary options investors pay close attention to any changes in the official cash rate.

The RBA last time cut its cash rate was on May 2015, when it was reduced to 2% from 2.20%. The forecast for this month was that the RBA will leave the cash rate unchanged for the time being and the RBA did leave it at 2.0%.

Trade Recommendation for the AUD/USD

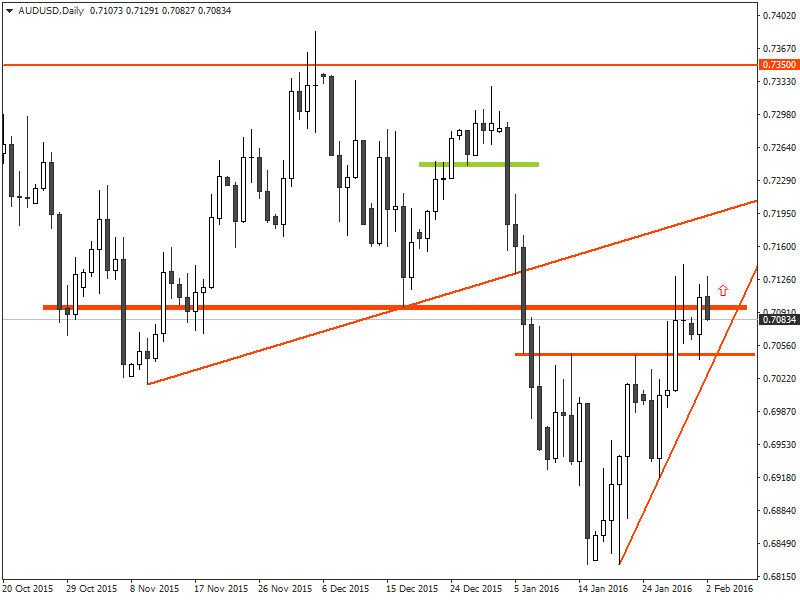

Since reaching as low as 0.6825 on January 15, the AUD/USD has started a bullish retracement move after the equity markets due to the sharp downturns in the US equity markets.

Over the last two weeks, the AUD/USD has gained 300 pips and last week, the price closed above the important intermediate resistance level around the 0.7050 level.

As the RBA cash rate and US ISM Manufacturing PMI both remained unchanged, the fundamental outlook for the AUD/USD would likely remain neutral this week. However, from a technical perspective, there is a good opportunity to place a call order, because yesterday, the AUD/USD price has closed above 0.7100.

Under the circumstances, it is recommended that traders consider placing a CALL order for the AUD/USD with their binary options brokers at current market price, as long as it is trading above the 0.7050 level.

Recommended Broker: BinaryBrokerZ

BinaryBrokerZ is one of the most popular binary options brokers. Check our our Binary BrokerZ review.

- Social Trading

- Up to 150% Deposit Bonus

- Up to 91% Payout

Tagged with: AUD/USD • Trade of the Week