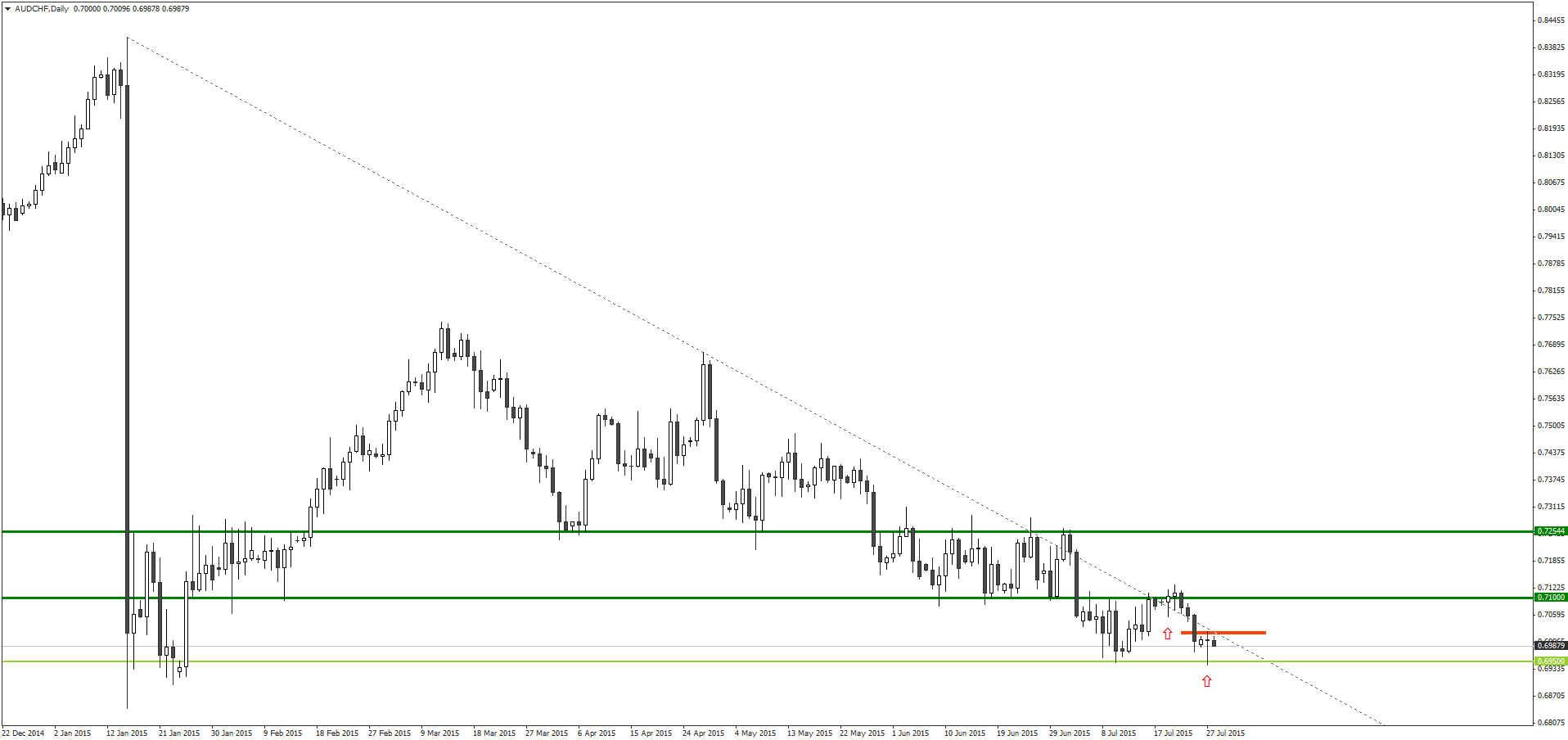

As the Greek bailout issue created uncertainty over the Euro, the demand for the safe haven currency, Swiss Franc, in Europe was up. As a result, the CHF appreciated around 730 pips against the AUD since April 15.

As the Swiss Franc appreciated against other major currencies, it had negative effects on the Switzerland’s export goods and services, as the cost of buying Swiss products went up in the international market.

Commenting the Swiss Franc, however, Karsten Junius, the Chief Economist at Bank J Safra Sarasin told the press last week that “We believe that the economy can cope with the current level of the exchange rate and will improve over the course of the second half of the year such that no further loosening of monetary policy will be needed.”

On Thursday, the KOF Economic Research Agency is scheduled to release its Economic Barometer Index reading, which binary options traders are expecting 90.3 against last month’s 89.7.

As the industry analysts and fundamental indicators are suggesting that the Swiss economy would be able to “cope” with a strong Swiss Franc, and additional bullish pressure was lifted amid the Greece bailout deal, it would likely main bearish in the medium-term.

Yesterday, the AUD/CHF formed a bullish pin bar after the price was rejected around the important support level near 0.6950. Hence, from a technical aspect, the AUD/CHF is likely to start a temporary bullish retracement move towards the 0.7100 level this week.

Under the circumstances, it is recommended that trader place a CALL order for the AUD/CHF with their binary options broker once the price penetrates above yesterday’s high, which is at 0.7022.

Recommended Binary Options Brokers

| Broker | Max.Bonus | Min.Deposit | Rating | Good Points | Max.Payout | USA | Regulation | |

|---|---|---|---|---|---|---|---|---|

| Free $10,000 Demo Account | $10 | 5.0 | Top Regulated Broker $10 Min.Deposit Free Demo Acc. #1 Crypto app | 98% | Not | - | VISIT IQOPTION IQOption Review |

| Free $10,000 Demo Account | $10 | 4.8 | Best Platform $10 Min.Deposit Free Demo Acc. Quick Withdrawals | 90% | Not | International Financial Commission | VISIT OLYMP TRADE Olymp Trade Review |

Tagged with: AUD/CHF • Free Signal